Creating your own cryptocurrency can be an ambitious undertaking so let me answer the most important question, ‘How are new cryptocurrencies created?‘

Although crypto can be made in just ten minutes using specifically designed software, some other forms of creating currencies are more complex.

You will likely require some financial resources, and guidance on development, marketing, and documentation.

Let’s dive in shall we, but first, a short disclaimer, this is not an article about financial advice, but rather an explanation of my own views on how to create your own cryptocurrency.

Factors to Consider Before Making Your Own Crypto

Before you launch, or even begin to develop a new coin, you will need to consider some key factors. They could ultimately affect the overall success of your crypto.

These are issues that include:

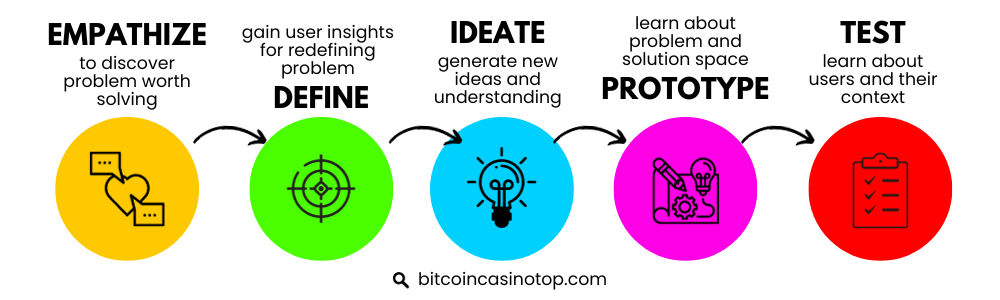

- Design research and planning of the intended usage of your currency. This five-step process is explained in the diagram below.

A Five-Step Process for Designing, Researching, and Planning the Intended Use of Cryptocurrency Step Action 1. Research - Based on user-centric thinking

- Involves research on customer needs

- Empathize and forget personal assumptions

- Understand target market needs & problems

2. Define - Analyze findings from the research stage

- Define the problems identified

- Create a problem statement based on your findings

3. Ideate - Collect ideas to solve the issues in the problem statement

- Answer the question ‘How might this Blockchain solve problem XYZ

4. Create prototype - Choose the best possible solutions to the problem statement

- Experiment with scaled-down versions of your currency

- Implement solutions then either accept, reject, or improve them

5. Test - Test the first version of your crypto

- Record any problems or issues testers face

- Either proceed or alter your project

- Find a development team

It can be quite difficult to launch your own crypto without any help. Even if you are a tech whizz, you will probably need people with expertise in different types of crypto.They could help you test your Blockchain and make sure there are no loopholes; especially in terms of security and verification. - Consider legal implications

Make sure you have all the legal information about creating and implementing a new cryptocurrency. We’ll discuss this in detail a bit later. - Conceptualization and white paper development

Creating a publicized white paper can make the difference between attracting serious investors, or being dubbed as a joke or even worse, a scammer.

A white paper works to provide investors with important information about your project that includes:- Your objectives

- The amount of money/capital you require

- The quantity of digital coins to be put into circulation.

- How many tokens will you personally keep?

- The type of currency your crypto will accept as payment.

- How long will your ICO run for?

- Who is involved in the development and implementation team?

- What does your team look like? Yes, you can include CEOs, CFOs, and similar ‘blue-collar’ professionals. That is all good and well, but what about the tech engineers? You definitely need experts in the blockchain industry.

- What kind of blockchain technology will you use? Ethereum is touted to be one of the best considering the ease of creating ERC-20 tokens but feel free to search for comparable chains.

Your white paper should be available well before the launch of your crypto and should certainly not seem like a marketing paper.

- Implementing the initial offering (ICO)

You will probably find yourself in need of initial investors to provide capital before actually launching your crypto. This process is called an Initial Coin Offering (ICO). Investors provide money to acquire unique cryptocurrency tokens and it is essentially comparable to the all-popular crowdfunding.Tokens are used as a unit of currency and grant investors special access to various features of your crypto. Essentially, you are trading tokens for financial investments.Features of such types of tokens include:- They can be traded in various supporting exchanges.

- They can be easily transferred across the blockchain network.

- They provide access to specific services.

- They give investors options to accrue company dividends.

Investors contribute X amount to buy initial tokens and receive Y amount of the limited tokens at a preset date.

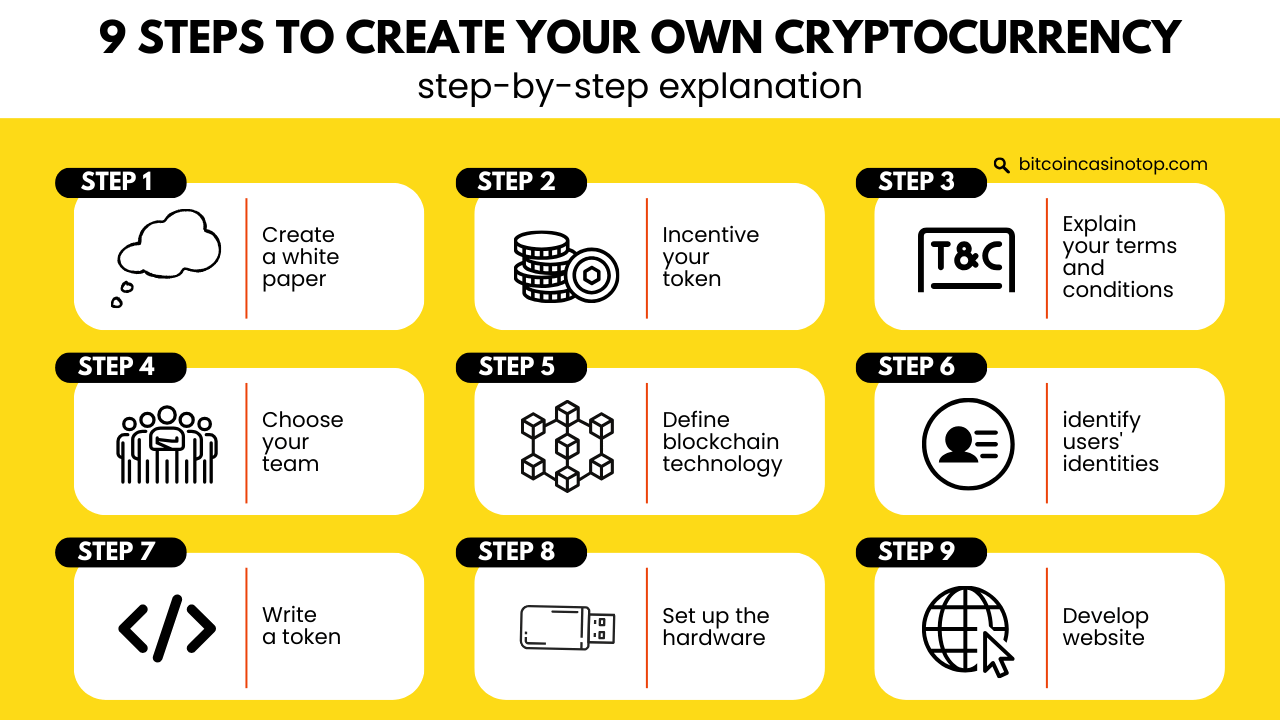

Here is a checklist you might want to refer to before creating your own cryptocurrency.- Create a white paper as discussed above.

- Incentive your token – why would investors or potential users contribute to your ICO?

- Explain your terms and conditions. Who can and can’t contribute to your ICO? How will you spend the funds that are raised? What is the method of token distribution? Will the rest of your team keep tokens for personal use?

- Choose your team wisely and ensure you have access to all the expertise you need.

- What Blockchain technology will you use? Ethereum has a stellar reputation for allowing the use of ER-20 tokens but keep your mind open to other blockchains.

Also, consider if you will offer a discount on the token price depending on the date of a contributor’s capital contribution. - How do you plan on executing your crypto launch? You will need to take note of criticisms around the fairness of past ICO launches.

To prevent negative talk, create a verification mechanism to identify users’ identities before they purchase ICO tokens.

Keep in mind KYC procedures, that if properly implemented could prevent your cryptocurrency from a complete bust. - Write a token & crowdsale smart contract and with reference to Ethereum, you could use Open Zeppelin libraries. These will help you access and securely use their crowd sale and token smart contracts.

Contributors however need to pay high gas fees so use the sparingly. It is a must that you realize that you are dealing with people’s money so make sure to perform thorough testing and auditing of smart contracts. Keep testing, auditing, and refining. - Set up the necessary hardware before the launch date. You will need a wallet to store the funds you collect from the ICO.

Think about using a multi-sig hardware wallet or USB cold wallet that will be relatively safe from crypto hackers.

Ideally, maintain more than one wallet in case the original one is compromised. If you do decide to use Ethereum, you will need to sync a node to the Blockchain as well as another main network to fully launch and test your smart contracts. - Develop a dedicated website for your crypto. It will need to be useable and able to provide simple and understandable instructions for contributors.

To place yourself amongst the league of professional ICO sites, think about including a login system that will let users manage their accounts. A dedicated portal will also let them upload or download necessary documents.

Answer these relevant questions as a way to nurture trust and accountability.

How are New Cryptocurrencies Created?

So now, with these factors in mind, you can begin to plan and build a sustainable crypto.

Before we delve into the technological aspects of this process, here are five tips to remember as you read the below steps.

- You can never market enough so place yourself right where cryptocurrency traders like to be.

- Take advantage of video marketing to increase conversions.

- Attend in-person networking events to create a real rapport – it helps them to see you in person.

- Follow potential investors to learn about their investment histories.

- Don’t be in a rush to launch your currency or token. It takes time to create market hype even before an ICO is announced.

The bottom line – get as many people to talk about your project and develop a loyal community around it.

Steps to Making Your Own Cryptocurrency

If you have planned properly, making a cryptocurrency does not have to be a painful process. Although cryptos are lucrative, the high level of risk means you will not automatically earn fast cash.

Long-term success can be a challenge that requires dedication and sometimes, a hefty capital injection.

You will also need to have some technical skills or consult with someone who does. Depending on the method you choose when building a cryptocurrency, the level of difficulty varies as explained below.

Below, are four of the most commonly used methods for making a cryptocurrency, which I will outline in brief.

Note that depending on the method you choose when building a cryptocurrency, the level of difficulty will vary.

Method 1: Write your own blockchain code and create a unique cryptocurrency.

This is the most challenging method yet it gives you the most freedom. It will require you to have experience in blockchain development but you can write any type of code you want.

From a technological perspective, it is the best way to develop crypto and supporting Blockchain. This is especially true if you plan on creating a solid crypto with ambitious plans.

To begin this process, you will need to choose a reliable blockchain operating protocol. Also known as a consensus mechanism, it is how new blocks are mined, verified, and added to a blockchain.

The two most popular mechanisms are Proof of Stake(PoS) and Proof of Work(PoW).

| ⛓️ | Proof of Stake | Proof of Work |

|---|---|---|

| Purpose of creation | Original Bitcoin algorithm used to mine and add new blocks to a Blockchain. | An algorithm was developed in 2012 to address the issue of Bitcoin’s massive energy consumption as a result of blockchain mining activities. |

| Who uses it? | Crypto miners who are connected to the Blockchain network via nodes. | Crypto miners who are connected to the Blockchain network via nodes |

| How does it work? | Crypto miners compete to solve a complex cryptographic puzzle using powerful computational hardware. This process is very energy-intensive. | An algorithm will choose which nodes in a blockchain can mine new coins. The decision is made by looking at which miners have the most amount of cryptocurrencies they hold in the network. |

The PoS method is more popular among newer Blockchain networks due to its fast transaction speed and the relatively low energy and equipment costs.

Method 2: Modify an existing blockchain’s code

A slightly simpler way to create crypto tokens is by customizing another blockchain’s source code.

Most codes are open source so you can view and download them from GitHub.

With adequate technical knowledge, you can change the code to suit your needs.

Again, ensure you do comprehensive research on the legalities and regulations that apply. Find out what rules you must adhere to when changing a company’s source code in your locality.

Method 3: Use an existing blockchain to create a new crypto token

This method of crypto creation is ideal for crypto developers who want to avoid the expense and effort required to create or alter blockchains.

NOTE: Cryptocurrencies are native to specific blockchains. Crypto tokens on the other hand; are crypto assets that are created on blockchains that support the creation of smart contracts.

In the case of creating crypto on an existing blockchain, you will essentially be creating tokens.

There are numerous blockchains that make it possible to create crypto tokens. The most common include Ethereum and BNB Smarter Chain. We will take a brief look at these later.

It’s fair to say that it is a lot simpler to execute than the above two options and below, I have summarized the steps you need to get started.

-

- Choose a Consensus Mechanism based on the research you have conducted.

- Identify an appropriate Blockchain platform based on your consumer mechanism.

- Prepare your network of nodes that is a connection of powerful computers to the blockchain network. These will need to be able to record and add data to a digital ledger so be sure to consider:

- Who has access to the network? Is the network publicly available or will it remain private?

- Do you want to use cloud or on-site hosting for support?

- What operating systems will cater to your needs? Consider Ubuntu or Fedora as they will allow you to configure the OS as per the cryptocurrency’s operational needs.

- What hardware would you need? Plan on acquiring enough hardware that can facilitate faster processing speeds.

- Decide on the best Blockchain architecture keeping these three formats in mind.

- Centralized architecture that allows one node to receive and process information from all the other nodes in the network.

- Decentralized architecture would mean all the nodes can share data and information with each other.

- Distributed architecture comes in two formats. The first would allow users to access a public blockchain ledger and review ledger content.

The other form is through a private distributed ledger that allows users to amend ledger data.

- Develop an Application Programming Interface (API). This is software that links to your chain’s nodes or client network.One way this happens is through an interface between a crypto exchange and software that analyzes historical and current cryptocurrency data.

- Configure the user interface considering the way users will interact with it. Look at variants such as ease of use, accessibility, mobile access, and transaction speeds.These will all affect the type of user experience (UX) and user interface (UI) you develop.Easy-to-use interfaces will allow your crypto traders and miners to comfortably manage their investments.

Look for someone with the skills to create a website or design a software program to let users review and configure their settings.

Once you have completed these steps, you should be able to launch your crypto tokens on your chosen Blockchain(s).

Method 4: Use a crypto development service.

For those who want their own cryptocurrency but would rather not spend the time and energy to create it; there are crypto token developers for hire.

They offer services, some via accredited companies or through freelance services.

Services they provide involve:

- Writing your white paper as per your requirements.

- Arranging an ICO.

- Creating your crypto token.

They have the expertise to create your crypto from start to finish – but at a fee of course.

Is it Legal to Create a Cryptocurrency?

Yes, it is perfectly legal to create a cryptocurrency even if it’s unregulated by government agencies

However, the debates around enforcing regulations are heating up. This will result in more questions regarding factors such as:

- The nature of the crypto coins.

- The purpose of creating the crypto.

- The currency’s business model.

To be fully legally compliant, you need a cryptocurrency broker license. This license will allow your crypto business to operate wherever it is registered.

In the US, crypto licenses are issued by FinCEN, the regulatory body that covers most of America. You must pay a government fee of $176,226 along with an annual fee of $136,855.

You will still need to check with the local state government as if this blanket license covers that specific state.

Due to the fluid and anonymous nature of crypto trading, your business will also need to comply with other legal issues including:

- Instituting Anti-Money Laundering (AML) policies to ensure funds are not used for criminal activities.

- Maintaining appropriate Know Your Customer ( KYC) records. You do this by collecting and verifying customer details. You then need to assign each customer a risk rating and perform ongoing risk reviews.

- Implementing a Combating the Financing of Terrorism (CFT) program to work alongside AML and KYC to fight funding of terrorists’ activities.

- Submitting reports of suspicious behavior to the authorities.

- Providing full details of your employees and partners.

If you are not a legal professional, seek help from the legal field, preferably with knowledge of Blockchain rules. This could save you financial and emotional stress in the long run.

Edward’s Ackins advice: Most cryptocurrency businesses will benefit from starting a limited liability company (LLC). By starting an LLC for your cryptocurrency business, you can protect your personal assets, increase your tax options, and improve credibility.

Will I Make a Profit From My Own Cryptocurrency?

Based on the business model you have based your crypto on, the answer can go either way.

It could be yes if your aim is for your currency to be a trusted part of the crypto world. This requires thorough planning and it’s a good idea to develop a white paper.

Establishing an online presence and creating an informative website is also a good idea and a way to market yourself to potential investors.

These investors also watch out for new cryptos that could have early profitable outcomes. Catch their eye by ensuring you are visible on platforms such as Coingecko. This is just one of many websites that regularly post information about new cryptos and trending news.

As you have read, using different methods you no longer have to wonder how to make crypto.

I trust this article will give you a foothold into crypto creation. If you are not a highly experienced cryptographer or coder, I have provided fairly simple ways to launch your own crypto coins.

For those with more adept technical skills, you can choose between creating a new blockchain code or changing an existing one.

Remember, always keep in mind the laws and regulations in your area surrounding the creation of cryptos.

Enjoy making your new crypto!

If you decide to use the services of blockchain programmers, marketing companies that will list your crypto coin on exchanges and decide to conduct ICO, then the amount of your spending will be at least $150,000 dollars to launch 1 cryptocurrency (digital coin).