You might have heard of Web3, also known as Web3.0 – you might be interested in knowing how to invest in Web3 projects. In this article, I will guide you through the process of investing in Web $ projects. This easy-to-understand information will help you in making wise investment decisions.

I will also explore the types of projects you could invest in as well as things to consider before making investment decisions.

What is Web3

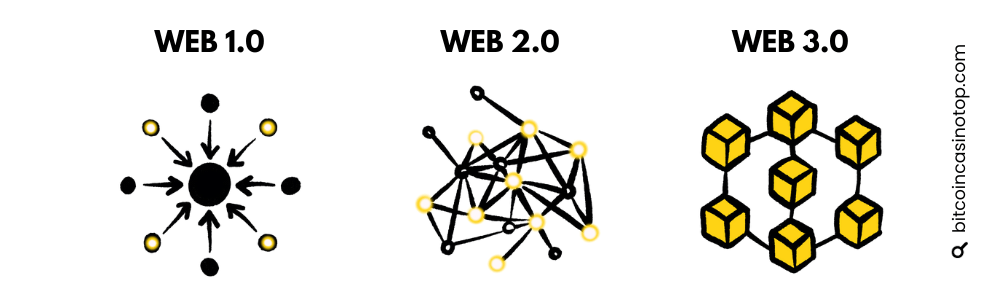

Web 3.0 is essentially the next generation of the World Wide Web. It is unlike Web 2, where information was distributed through interactions and social media.

It is also not comparable to Web1 which had little or no interaction; but consisted of static content.

So now we welcome Web3 which is used mostly to provide useful digital services. Essentially, it is an open decentralized, all immersive web.

Web 3 uses the now common Blockchain technology to secure and manage the data it receives. This data is unchangeable as it is stored in blocks along a blockchain.

It has been featured in popular tech events such as the Web3 Expo as well as the Miami Web3 Summit. Some features that make Web 3 different from its predecessors are its decentralized nature and use of AI and machine learning.

It also uses smart applications and allows users to have complete ownership over the data and how it is shared.

It has a reach of $33 million with an expected compound annual growth rate (CAGR) of 47% between 2023 to 2032.

Before we dive into how to invest in Web 3 projects, let’s consider what to consider before doing so.

What Should I Consider Before Investing in a Web3 Project?

Especially for first-time Web3 users, you need to fully understand what you’re getting yourself into.

True, it might seem like such a lucrative deal that you jump right in. But be careful before you make any investment decisions.

Here, let me give you a few tips on what to consider as we answer the question, ‘how to invest in Web3’.

You will need to find out:

- Your investment goals

Think about the intention of your Web3 crypto coins. Is it for profit? Community interaction? There is a proliferation of unique Web 3 projects so look for those that align with your investment goals.Research and map out your investment goals and timeline.

- The team behind the Web3 project

It is necessary to know the team behind this particular Web3 project.Look for companies with publicly known founders that will allow for more accountability and risk cushioning. They should have a reputable track record and have ideas on how to solve real-world problems.

- Your risk tolerance levelAs with any investment, only invest what you are ready to lose. It is likely not all projects will succeed so diversify your portfolio by investing in different assets to reduce the impact of failure of one of your investment projects.

- Your country’s Web3 laws and regulationsMake sure to fully research and understand the laws around Web3 in your region. Stay updated on the laws and regulations around cryptocurrencies and blockchains, This will guarantee compliance with the law and prevent you from landing in hot water.

Process of How to Invest in Web3 Projects

So now you are knowledgeable about Web 3 and have considered the above factors before investing, here is a step-by-step guide on how to make Web 3 investments.

- Educate Yourself

Build a strong foundation by understanding the technology underlying Web 3 technology. Keep abreast of blockchain, decentralized applications (DApps), and smart contracts. Make sure you know the areas within and around the Web3 environment such as decentralized finance (DeFi) and non-fungible tokens (NFTs) among others. - Make the Relevant Considerations

Consider the four factors mentioned above including your investment goals and risk tolerance level. Your decision will be based on whether you want long-term or short-term growth. Are you willing to deal with high-risk high-reward investments or are you more risk-averse? Clarify your investment horizon and risk tolerance levels. - Thoroughly Research Your Investment Projects

Investigate the project’s development team to ensure credibility and transparency. Read every proposed project’s whitepaper to fully understand its objectives, technology, and guiding roadmap.It should also contain innovative real-world solutions, a clear vision, and a practical use case. It must be relevant to our digitized world. Projects that have a strong community around them are usually healthy and likely to succeed.Engage with this community online and especially on social media. Look for projects with growth potential through strong partnerships and collaborations. Make sure you understand the token distribution, utility, inflation, and deflation mechanisms. This will determine the project’s long-term prospects.

- Choose a Secure Cryptocurrency Wallet

You will need a crypto wallet before you can start investing in Web 3 cryptos or tokens. Choose a wallet that supports the specific assets you plan on investing in. Software wallets such as MetaMask are ideal for various blockchain networks.For added security, you will need to look for hardware wallets such as Trezor or Ledger or store your digital assets offline on a USB. - Choose a Reliable Crypto Exchange

Many Web3 projects will need you to buy crypto coins or tokens. This will require you to engage with a reputable exchange. Choose one such as Ethereum or other major exchanges such as Binance and Coinbase. Choose those with good reputations, keen security, and efficient customer service. - Understand Tokenomics

Investors will most likely purchase crypto coins or tokens native to a project. This means you need to understand the currency’s use cases, market demand, and supply and distribution mechanisms. Try to fully understand how coins are mined and tokens created. You need to know of the project’s distribution mechanisms and evaluate its potential value. - Diversify your Portfolio

Make sure to spread your investment across different projects to help mitigate risks. It also allows you to capture lucrative opportunities in different sectors of the Web 3 landscape. - Consider Risk Management Tactics

Investing in Web 3 projects has inherent risks that are due to technological challenges, regulatory changes, and market volatility which will affect the price of your investments. Invest only what you can afford to lose and set up stop-loss orders to limit your losses. - Long-term vs Short-term Perspective

Taking a short-term view of projects is not wise as fluctuations may not reflect the true potential of a project. It may be profitable due to speculation but rather, take a long-term view of projects to allow them to gain traction and fully develop. They need to have a sustainable business model and solve real-world problems. - Engage in Governance

Many Web 3 projects offer governance tokens that will let investors participate in the project’s decision-making. This allows investors to influence the project’s future and the direction it will take. - Beware of Scams

With thorough research, ensure you are not investing in scams or fake projects. Verify their authenticity and always keep your crypto keys and personal information private. Be cautious before investing and check all security measures are in place to safeguard your funds.

What Types of Web3 Investments Can You Make?

Here is a quick guide on Web3 projects you could invest in.

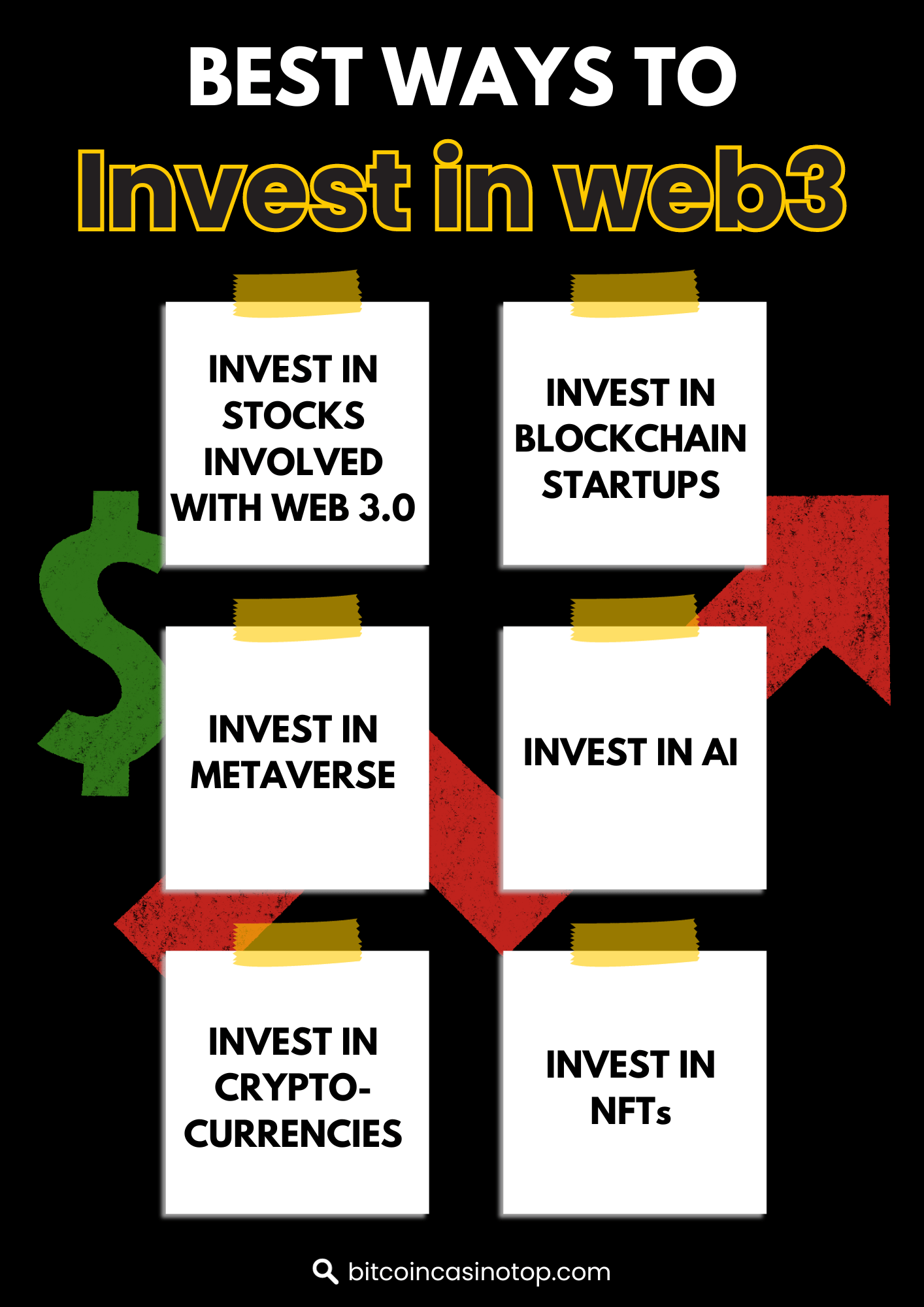

- Invest in Blockchain Web3 Startups

The first step is to identify and research a promising Web3 startup. Ideally, they should offer innovative solutions and reliable teams.Make an early investment through Initial Coin Offerings (ICOs) or by becoming an angel investor. You could also invest in a software company that has cryptocurrency software development capabilities and experience in the field. - Invest in Stocks Aligned With Web 3.0

Investing in Web 3 stocks is also a great way to make a profit. How do you do this?Look for companies actively engaged in Web 3-based technologies such as:- Blockchain

- Decentralized Applications (dApps)

- Blockchain-based games

- NFT Marketplaces

And although it’s not a must, try to find an investment project that can function on the Ethereum Blockchain.

Tip by Ed Ackins – Find a reputable online broker who will make it easy for you to access and manage your stock investments.

- Invest in Non-fungible Tokens

Non-fungible tokens (NFTs) have made it extremely easy and often fun to buy.NFTs are digital assets that have gained popularity as a form of investing by buying unique digital assets.These often include things like collectibles and virtual real estate.

Follow these steps before investing in NFTs:

- Confirm the authenticity of each good and be wary of skillfully made copies.

- Be mindful of following mindless trends.

- Carefully research the creator of the NFT.

- Search well-known NFT marketplaces including Nifty Gateway or Rarible before making a purchase. You then invest in these NFT markets, and by buying the NFTBOX script, you can make and sell platforms for users.

- Invest in Cryptocurrencies

Popular We3 cryptocurrencies are an ideal way to make some extra money.Think of cryptos such as Bitcoin and Ethereum which are at the heart of Web3. These are thought to be the best web3 cryptos.By buying and holding these digital tokens, you will see increased value over time.

- Invest in DeFi platforms

Another option is to learn about decentralized finance (DeFi).These are platforms that allow you to borrow and earn interest on crypto assets. - Invest in the Metaverse

The Metaverse is an emerging concept that blends virtual and physical realities. Its potential is clear as most tech giants are investing in Metaverse. You can also enter the fray by investing in metaverse technologies, virtual reality (VR), augmented reality (AR), and other digital experiences. - Invest in AI Technology

AI or Artificial Intelligence bolsters Web 3 innovations. Invest in AI-focused companies or those actively involved with AI technologies.

Challenges of Web3

There is no type of software technology that does not have its challenges and Web 3 is no different.

Although it has its own benefits as seen above, it does have a number of downsides.

Before making any investment, make sure you understand both sides of the coin. If not, you could just be throwing your hard-earned money down the drain

- Lack of scalability:

Blockchain in general sees huge influxes of traffic, but often, the infrastructure that is required cannot handle this amount of traffic.Developers need to improve the underlying Blockchain technology. - Security

Securing Web3 technologies has proved to be another challenge. It is inherently designed to be secure, yet there have been some notable hacks.This is a very serious issue as proved by the fact that by Q2, 2023, Web3 had lost over $300 million through malicious incidents. - Development

The development of Web 3 is still in the early or primary stages. This leaves numerous unknown variables or questions about whether it will work or how people will adopt it.This lack of rapid development means Web 3 cannot yet gain widespread adoption.

Final thoughts from Edward Ackins

So there you have it. Your brief guide on how to invest in Web 3 projects. After reading this article, I hope you will be confident in making Web 3 investment decisions that align with your goals.

Web 3 can cause an Internet revolution and offer new opportunities for investors. Perform your due diligence before investing and stay updated for a successful investment venture. Approach investments with caution, stay informed, conduct your research, and develop a clear understanding of the risks involved.

Best of luck with your Web 3 investment projects.

Related article: Web3 casino – play online using crypto