The Bitcoin regulation in Australia focuses on preventing financial crime and protecting consumers. The regulatory landscape includes legal recognition of Bitcoin, stringent AML/CTF measures, and clear tax obligations. Therefore, this article aims to make sense of the current framework, the government’s stance on the legality of Bitcoin in Australia, and the issues surrounding the taxation of digital assets. We’ll also cover how anti-money laundering measures apply, the latest developments in the industry, and what the future might hold for cryptocurrency exchanges in the Australian market.

A Brief About The Bitcoin Status in Australia

Australia is a critical player in the digital revolution and has embraced the use of cryptocurrencies – most notably Bitcoin – in the country. The numbers support this notion, as studies show that up to 4.5 million Australians own some type of cryptocurrency.

The use of Bitcoin ATMs, especially in major cities like Melbourne and Sydney, has been consistent. These ATMs make it easy for users to access their Bitcoin wallets.

Related: What are Bitcoin ATMs, and how do they work?

With increased popularity, more individuals and businesses are incorporating cryptos into their long-term investments and everyday transactions. This regulatory landscape not only promotes transparency and security but also supports the growth of the burgeoning fintech sector.

Additionally, major companies, including Coca-Cola, BMW, and Starbucks, are also accepting Bitcoin payments. This growing trend and the high adoption rate have resulted in rapid change and more complex regulations and compliance requirements. Relevant authorities are tasked with developing a comprehensive framework that addresses these changes. For this reason, Australia has a set of Bitcoin regulations to manage the thriving industry.

Is Bitcoin Legal in Australia: Current Regulatory Environment

Yes, Bitcoin is legal in Australia. However, it is not considered legal tender, which means it’s not a form of currency recognized for settling debts. The Australian Taxation Office (ATO) considers BTC an asset for tax purposes. This means any capital gains or losses incurred when buying, selling, or trading Bitcoin are subject to capital gains tax.

Therefore, Is Bitcoin trading legal? Yes, Bitcoin trading is legal. However, users must comply with Bitcoin regulations in Australia, such as taxation, Anti-Money Laundering, and Counter-Terrorism Financing (AML/CTF) compliance. They must also obey regulatory bodies such as the Australian Transaction Reports and Analysis Centre (AUSTRAC) and the Australian Securities and Investments Commission (ASIC ensures that cryptocurrency businesses operate within the legal framework, protecting consumers from fraudulent activities.

It is also essential to note that Bitcoin regulation in Australia is overseen by the Australian Transaction Reports Commission (AUSTRAC) and the Australian Securities Exchange (ASIC). These authorities provide different yet complementary services essential for controlling how virtual cryptocurrencies are used and traded in Australia.

Let’s take a brief look at these institutions below.

The Australian Transaction Reports and Analysis Centre (AUSTRAC)

This body is responsible for preventing money laundering and financing terrorist activities (ML/TF). They work under instruction from legislation passed in 2018 that obligates crypto exchanges to register with the authority and comply with anti-money laundering (AML), counter-terrorism financing (CFT), and Know Your Customer (KYC) guidelines.

This mandate aims to reduce the risk of exploiting or using cryptocurrencies for illegal purposes. The overall objective is to increase transparency and ensure the currencies do not threaten the country’s financial security.

When you apply for a license with AUSTRAC, they can either grant your application or refuse to give you a license. Ensure you complete all the required registration information and respond to requests for additional information.

If your business poses a risk of money laundering, smuggling, terrorism financing, or other criminal activities, AUSTRAC can suspend or cancel your license.

Failure to meet your obligations under these laws may result in legal actions or enforcement actions such as:

- Infringement notices: If you breach AML/CTF rules, AUSTRAC can issue infringement notices for the specific breaches mentioned below.- Accurate reporting

– KYC procedures

– Enrolling and registering with AUSTRAC

– Comprehensive record-keeping

– Providing relevant information to AUSTRAC - Civil Penalty Orders: AUSTRAC can obtain a penalty order from the Federal Court requiring you to pay a fee to the Commonwealth. These fees are calculated according to the current value of penalty units.

As of 1st July 2023, one penalty unit was valued at $313, meaning if you have a penalty order of 100, you will pay a total of $31,300 in fines. - Enforceable undertakings: These are written commitments that explain how you will adhere to the AML/CTF legislation in the future. If you make such a commitment, the terms are binding, and if you are in breach of them, AUSTRAC can apply for enforcement from the Federal Court.

- Remedial directions: AUSTRAC can instruct you to perform specific activities to attain full compliance with parts of the AML/CTF Act. These instructions ensure you do not perform the same breach and provide information you may have neglected to give AUSTRAC.

- Written notice to appoint an external auditor: You may be ordered to engage an external auditor if AUSTRAC officials believe you need to take more measures to identify, mitigate, and manage the risk associated with ML/TF. They may also issue a notice if you still need to comply with the AML/CTF Act.

- Written notice to conduct an ML/TF risk assessment: If your ML/TF assessment is considered inadequate or outdated, you may have to perform a more rigorous evaluation. You will then need to send it to the center for review.

NOTE: It is illegal to operate as a DCE provider unless the service provider is registered with AUSTRAC, so ensure you receive your license from an authorized company.

The Australian Securities and Investments Commission (ASIC)

ASIC is tasked with classifying digital assets as financial products and services. Under the Corporations Act 2001, they have ruled that Bitcoin and other cryptos are not financial products or services but are treated as assets for taxation purposes. But this does not mean it has no control over the use of cryptocurrencies. ASIC requires services related to cryptocurrencies, such as custodial services (wallet providers) and exchanges to:

i) apply for an Australian Financial Services (AFS) license, and

ii) comply with AML and KYC regulations as mentioned above.

This license obligates you to develop a constitution and compliance plan and requires you to act responsibly.

Other roles of the ASIC include;

- Overseeing the operation of stock exchanges, ensuring fair and transparent trading practices, and regulating market participant activities.

- Protecting consumers and investors by providing resources and information to help consumers and investors make informed financial decisions and understand their rights.

- Preventing financial crime by Investigating potential insider trading and market manipulation and working with law enforcement agencies to prosecute financial misconduct.

- Regulating ICOs to ensure they comply with securities laws, requiring proper disclosure and protecting investors from misleading and deceptive practices.

- Ensuring companies provide accurate and timely financial reports and disclosures, maintaining transparency in the financial markets.

- Conducting investigations into suspected breaches of financial laws and regulations and taking legal action when necessary to enforce compliance.

Overall, ASIC plays a vital role in maintaining a fair, orderly, and transparent financial system in Australia. It achieves this by regulating markets, protecting investors and consumers, and combating financial crime.

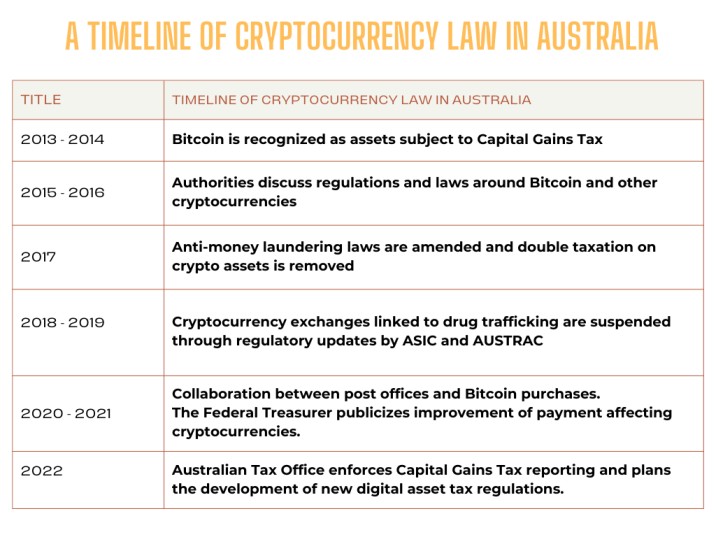

Here is a diagram summarising the timeline of Cryptocurrency Law in Australia.

Australia’s Latest Actions to Regulate Cryptocurrency

In an attempt to control and monitor the rapidly changing cryptocurrency environment, Australian lawmakers have attempted to implement various regulations and Bitcoin laws in Australia, including:

-

- Digital Currency Exchange (DCE) License: As of October 2023, it was mandated that all digital platforms and exchanges that trade cryptos must have a DCE license. This move ensures that service providers comply with the above-mentioned AML/CTF and KYC requirements. These include activities such as identifying customers and monitoring all transactions. Owning a license will also protect investors in case of business failure.

- Taxation: If your business or you as an individual are involved in Bitcoin and other cryptocurrencies as part of your operations, you must understand and comply with all Australian taxes on crypto to reduce the impact of potential risks.

Below are the key considerations for Australian tax for crypto:

i) Bitcoin and other cryptocurrencies are subject to normal Capital Gains Tax (CGT) if used for profit-making purposes or as an investment. This means you must report any gains or losses made from the transfer of cryptocurrencies as regulated by the Australian Taxation Office (ATO). To calculate CGT, find the difference between the selling price and purchase price of crypto assets.

ii) CGT does not apply if you use Bitcoin for personal use, such as buying goods and services, and the value of the transaction is less than AUD 10,000.

iii) Commercial activities involving cryptocurrencies, such as trading and mining, will incur a tax on any profits gained. The tax will be based on your personal or business income tax rate.

iv) For tax purposes, you will need to keep accurate records of transactions with details regarding buying and selling activities and the value of the coin at the time of the transaction. Keep records of relevant receipts, invoices, and exchange statements for recording and reporting purposes. Safely storing these documents will likely make your tax reporting much smoother.

ATP uses data matching and compliance mechanisms to identify taxpayers who under-report or simply don’t report transactions that should be taxed. Hence, we advise you to report all your cryptocurrency transactions accurately to avoid committing tax fraud and being penalized.

The Australian Tax Office (ATO) has set clear guidelines for the Australian tax on crypto. Understanding these tax obligations helps individuals and businesses navigate the cryptocurrency landscape responsibly and avoid potential penalties. Remember, cryptocurrency transactions are exempt from Goods and Services Tax (GST).

Bitcoin Regulation in Australia: Is Bitcoin Mining Legal in Australia?

Q: Is Bitcoin mining legal in Australia?

A: Crypto mining in Australia is legal and mining activities must be compliant with tax regulations and record-keeping practices. *Check out my informative article to learn more about Bitcoin mining here.

Yes, Bitcoin mining is legal in Australia. However, it is subject to certain regulations and tax obligations. For instance, If Bitcoin mining is conducted as a business, it may need to be registered with the Australian Business Register (ABR) and comply with relevant business regulations. In addition, Large-scale mining operations must adhere to environmental regulations, particularly regarding electricity usage and emissions. Also, mining operations should comply with consumer protection laws, ensuring they do not engage in deceptive or misleading conduct.

What are the Issues with Cryptocurrency in Australia?

While the Bitcoin regulation in Australia provides a clear, structured, and supportive framework for the Bitcoin ecosystem, several challenges remain.

- The lack of a single, comprehensive set of regulations creates uncertainty for businesses and consumers. This can hinder innovation and make it difficult for legitimate cryptocurrency businesses to operate.

- Despite regulatory efforts, cryptocurrency scams and frauds remain prevalent. The anonymous nature of cryptocurrency transactions can make it difficult for authorities to trace and recover lost funds.

- Unlike traditional financial products, cryptocurrency investments are not subject to the same level of investor protection offered by government agencies.

- The tax implications of cryptocurrency transactions can be complex, particularly for frequent traders and those involved in activities like staking and mining. Keeping accurate records and calculating tax liabilities can be challenging.

- The pseudonymous nature of cryptocurrencies can potentially facilitate tax evasion, posing challenges for the Australian Taxation Office (ATO) in ensuring compliance.

- The significant price fluctuations of cryptocurrencies can be risky for investors and hinder their wider adoption as a medium of exchange.

Currently, there’s a limited acceptance of cryptocurrency as a payment method by Australian businesses. - The cryptocurrency sector is a prime target for cybercriminals. Exchanges and wallets face risks such as hacking, phishing, and other cyber attacks, which can result in significant financial losses.

- The global nature of cryptocurrency transactions makes it difficult for Australian regulators to enforce laws and regulations, particularly when dealing with offshore entities.

Addressing these issues requires ongoing collaboration between regulators, the cryptocurrency industry, and other stakeholders to ensure a balanced and effective regulatory environment. Thus, the future of cryptocurrency in Australia remains uncertain. However, the ongoing development of Bitcoin regulation in Australia and industry efforts to address these issues could lead to a more mature and secure cryptocurrency market in the future.

What New Laws Does Australia Propose to Regulate Crypto?

Australia is proposing a new wave of regulations to tighten its grip on the cryptocurrency market. The proposals are;

- A licensing Regime for Crypto Asset Secondary Service Providers (CASSPrs) will require CASSPrs to meet specific standards and obtain a license to operate legally.

- Strengthening Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Regulations to cover more cryptocurrency-related activities.

- Perhaps betstop.gov.au will start regulating Australian bitcoin casinos as well.

- Regulation of Decentralized Finance (DeFi) platforms to comply with existing financial regulations and ensure they implement adequate security measures to protect users.

Conclusion

Australian authorities continuously update regulatory requirements to protect customers and mitigate the inherent risks associated with Bitcoin. Their approach seeks to support innovation and the use of Blockchain technology and promote the responsible use of cryptos. Illicit activities can only be prevented with collaboration between regulators, stakeholders, and the public. For example, regulatory bodies like AUSTRAC, ASIC, and the ATO play critical roles in overseeing and enforcing the rules governing Bitcoin’s use and trade. Additionally, the government is proposing a licensing regime for cryptocurrency exchanges, aiming to bring them under a regulatory framework similar to that of traditional financial institutions. Overall, the Bitcoin regulation in Australia provides a clear, structured, and supportive framework for the Bitcoin ecosystem, offering confidence and protection to investors, consumers, and businesses.

Frequently Asked Questions (FAQs)