Bitcoin halving occurs every four years when the new coins’ creation rate is reduced by half. Here, I will explore this unique feature and how the lowered supply of Bitcoin affects its price.

Firstly, we will aim to understand how Bitcoin’s blockchain network operates, how the mining process creates new crypto, and how miners and traders are affected by a halving event.

After this, you will have a chance to look at:

- Expert advice

- What is Bitcoin halving or blockchain halving?

- Why it’s important?

For you potential traders or investors, I will also look at Bitcoin halving dates history and mining costs as well as the Bitcoin halving calendar to keep you up to date.

How Does the Bitcoin Blockchain Network Operate?

If you are new to cryptocurrency, all this jargon might sound like gibberish, but here is a simple explanation.

- Bitcoin works on blockchain technology that comprises a network of computers or nodes that share information.

- Each node contains Bitcoin’s software and the history of transactions on its network.

- Each full node approves or rejects a transaction individually only after all transactions in a block are approved.

- After approval, this block is added to the existing blockchain and sent to all the other nodes.

- The transaction is verified, and the Bitcoins can be moved from sellers to buyers.

When more computers join the blockchain, security and network stability are increased. As of May, 31. In 2023, approximately 17,195 nodes were running on the Bitcoin network. If you want to become a miner, you can join the network as a node if you have enough computational power to download and store the entire blockchain and its entire transaction history.

Keep reading to understand the mining process.

How Does Bitcoin Mining Work?

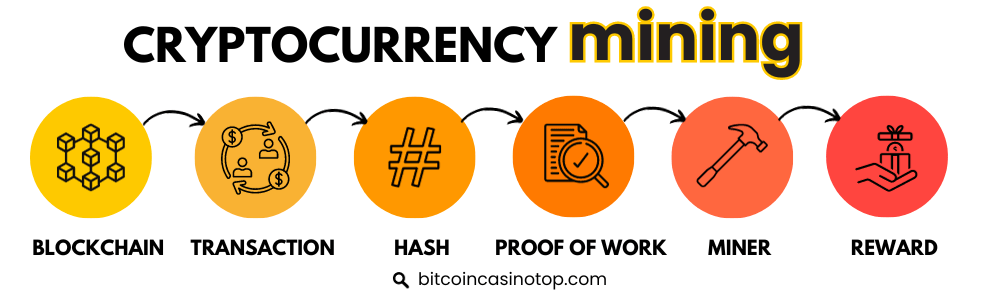

Mining activities refer to people using powerful computer equipment to verify and approve transactions. This is done by solving an encrypted alphanumeric code or hash before the other miners. It serves as Bitcoin’s consensus mechanism or Proof of Work (PoW).

The incentive? Bitcoins. Yes, the first miner to solve the puzzle is rewarded in Bitcoins – and this is why halving affects existing miners, as I will explain later.

Once a block has enough transactions, it is added to the mining queue and is ready for verification. Miners confirm the legitimacy of transactions in the block, and a new block is opened. At the end of this process, these blocks are linked together to form the blockchain.

Here is an easy-to-understand diagram explaining this process.

So, with regards to Bitcoin, the mining process will stop once 21 million coins are mined. The amount already mined and in circulation is currently over 19 million, or 89% of the total. After every four years, the rewards given to Bitcoin miners are halved.

Let me explain more…

What is Halving in Bitcoin?

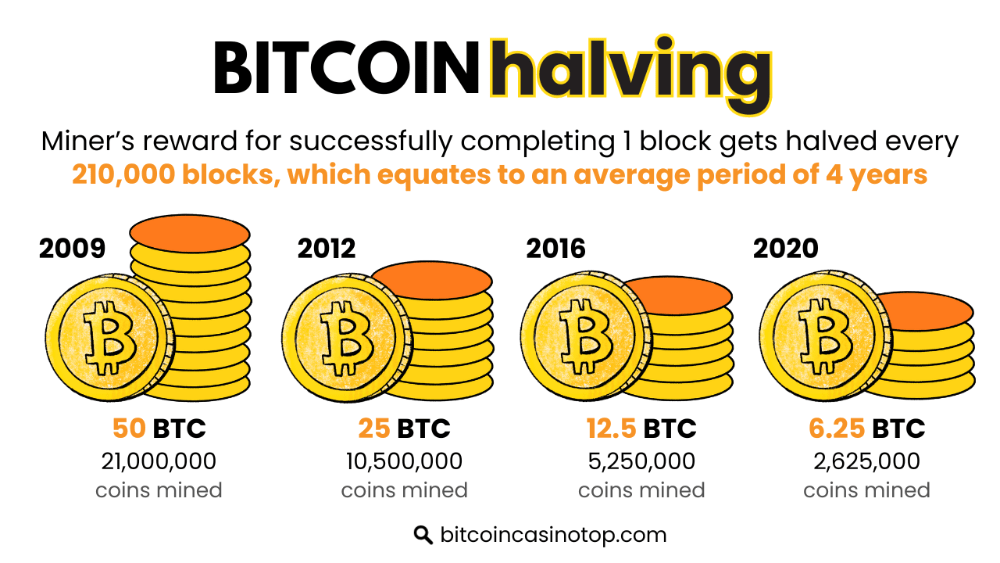

Bitcoin was launched in 2009, with 21,000,000 Bitcoins being mined and miners earning 50 BTC. Those first miners made a pretty penny until their rewards were cut in half when the first Bitcoin halving occurred in 2012. At this point, there were 10,500 coins mined and miners earned 25 BTC – still a tidy amount of crypto.

Two more halvings occurred in 2016 and 2020. This event occurs after every 210,000 blocks are mined, and the next one is set for 2024 – so let’s begin the Bitcoin halving countdown!

Usually, the expectation of a halving comes with increased demand, and because the supply is reduced, the price of each coin is set to increase. The downside for the miners is less reward.

They now earn 6.25 BTC, and when the next halving event occurs, miners will earn 3.123 BTC. This unique characteristic of Bitcoin is very useful in maintaining the value of the currency.

FUN FACT: The first block of Bitcoin is known as the Genesis Block and was the first 50 BTC of Bitcoin. It is shrouded in mystery as it cannot be traded, and the first transaction by the original client is untraceable. Was it created like this by mistake or by intent? No one knows…

Why Halve Bitcoin Anyway?

You might be scratching your head and wondering – so what is the point of all this? Well, one of the main reasons Bitcoin is still the most popular cryptocurrency is its scarcity.

Let me delve into this aspect of the coin along with a few other reasons for halving.

-

Maintain scarcity, limit supply, and control inflation

When Bitcoin was launched and set to 21 million coins, It was intended to be a controlled supply. By halving Bitcoin, the rate of coin production decreases and increases scarcity. This limited supply makes Bitcoin a deflationary digital asset that should keep rising in value as demand remains constant or rises after a halving occurs.

Inflation of Bitcoin is kept under control by decreasing the rewards given to miners. After the 2012 halving, inflation fell from 50% to 12% and again plummeted to under 5% after the 2016 halving. The result is a coin that remains valuable over the long term and maintains stability. -

Price increases

This aspect of halvings is proven in past halvings that have resulted in a decrease in supply and an increase in demand. This expectation of an increase in the price of Bitcoins results in positive market sentiment and, usually – a bull run.

Features of a bull run are:- High investor confidence

- Investors are buying coins

- Demand is higher than supply

- A rise in prices

Historically, this has been true, as shown in this Bitcoin halving graph, with quite large increases in prices after the halving due to increased demand.

Below are some more reasons why Bitcoin mining matters. -

Ensure fair distribution of currency

If you are one of those early miners, you may have earned excessive amounts of coins after having mined for many years. The halving process encourages an equitable distribution of crypto coins and helps the development of a more diversified customer base.

-

Manage market forces and economics

As I have mentioned previously, miners earn less BTC after a halving and will have to alter their operations to stay profitable. This lower reward results in some miners stopping their operations, resulting in increased competition for those who stay.

The problem is that having fewer miners can be risky as fewer people now ensure the security and decentralized nature of crypto coins – but that is simply the risk brought on by halving crypto.

These various reasons why Bitcoin halving occurs give us some more insight into the process. They also help us understand why halving matters.

Why is Bitcoin Halving Important?

Booms in the price of Bitcoin after a halving have been witnessed as it raises the value of unmined coins. More investors will be eager to buy coins, and usage of the currency in real life will increase.

Bitcoin’s halving effect is that it attracts a lot of publicity and press coverage, exposing it to more people across the world. Also witnessed after a halving process is a decline in the number of miners, which may generally negatively impact the entire cryptocurrency ecosystem.

The table below shows Bitcoin halving dates and their concurrent price.

| Date of halving | BTC earned per block before halving | New BTC earned per block after halving | The price of Bitcoin on the day of halving | The price of Bitcoin 150 days after halving |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | $12.35 | $127.00 |

| July 9, 2016 | 25 BTC | 12.5 BTC | $ 650.53 | $758.81 |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | $8821.42 | $10,943.00 |

If these large price increases look profitable, you might be wondering when Bitcoin’s next halving.

As the last Bitcoin halving was in 2020, the Bitcoin halving schedule puts the next one on the 26th of April 2024 at 11:59 pm.

If you are a crypto enthusiast, keep an eye on the markets!

In Closing – latest thoughts

As I have explained in this article, Bitcoin halving, also known as blockchain halving, automatically occurs every four years and halves the amount of Bitcoin available for mining. This plays a key role in the supply and demand, hence the price of Bitcoins.

I have also shown you how the blockchain works, as well as the mining process that is at the core of the crypto. I hope you now understand the main reasons behind halving, including price rises, maintaining scarcity, and economic factors, to name a few. I have also explained the importance of the halving event and showed how it has previously impacted the price.

Let’s hope this article provides information for you to make a successful investment before the next halving event.

Please note: Investing in crypto is subject to high risks. BitcoinCasinoTop.com does not provide financial advice. Instead, we write content only for informational and educational purposes.