Bitcoin mining – this a phrase you might have heard within the cryptocurrency world but not fully understand what it means. To explain, it is the process of verifying Bitcoin transactions in a block that is then placed in the blockchain.

They race to make as many guesses as fast as possible and when more miners join the network, the harder it becomes to solve the hash.

The first miner to correctly guess the hash, or is closest to it receives a reward of of 6.25 Bitcoins (BTC). These are set to reduce by half due to Bitcoin halving in 2024.

At the time of writing in January 2024, the current rate of one BTC was around $43,000, so if you are interested mining, you have $268,750 worth of motivation for individuals to aspire to become Bitcoin miners.

This incentive of owning BTC has lured many individuals to join the trade by practicing pool mining or solo mining. These are the two types of mining which we will look at later.

If you are looking to mine Bitcoin as a hobby, or as a source of income, keep reading as I answer the main question – “What does it mean to mine Bitcoin?”

How to Mine Bitcoin For Beginners

As my introduction mentions, mining is the process of adding new blocks of transactions to the Bitcoin blockchain. To do this, miners first need to invest resources in the form of equipment. Unfortunately, this can be very expensive.

The equipment needed to complete the mining process has evolved, becoming more sophisticated as the currency has gained popularity rising competition among miners.

Let’s take a quick look at what is required to mine Bitcoin.

What Hardware Do I Need To Mine Bitcoin?

Initially, Bitcoin mining was done using regular Central Processing Units (CPUs) and anyone could mine at home.

As Bitcoin mining became widely adopted, miners had to increase the number of calculations or guesses they had to make to solve the equation. This has made the mining process more complicated.

This popularity triggered a move to the use of Graphics Processing Units (GPUs). These are graphic cards that are inserted into machines to make PCs faster and more efficient than normal CPUs. GPUs however require constant cooling to keep the system from overheating as they try to meet the demand for high hashing speeds.

This has now resulted in the creation of Application-Specific Integrated Circuit (ASIC) miners. ASIC miners are computers that are specifically built for mining cryptocurrencies. They are generated using Proof of Work (PoW) and are mainly used for Bitcoin mining.

Due to the amount of competition between miners on Bitcoin, those with greater hash rates or hashing speeds will have the most profit. ASICs solve this problem with higher hash rates than GPUs but they are also more power-hungry.

To successfully mine Bitcoin, you will need:

- Hardware that can handle the hash rate. This is the rate at which your hardware can solve the equations. The higher the hash rate, the higher the chances you will solve the next block in the blockchain.It is measured by the symbol h/s and due to the sheer number of hashes on large blockchains, the hash rate is expressed as Th/s which is a measure of one trillion hashes per second.

- Hardware that is worth your money. Considering the price of ASICs, you will need to invest in equipment that will serve you well over the long term. If you plan on gaining a profit from Bitcoin mining, be ready to make significant capital investments. Cheaper hardware will have a lower hash rate and will not make your pursuits profitable.

- Energy-efficient hardware that will convert electricity into Bitcoin with minimal power consumption. The efficiency will depend on the cost of power in your specific location.

Here is a list of 2024’s Top Four Bitcoin hardware mining machines based on hash rate, price, and power consumption.

| Hardware | Hash Rate | Power Consumption | Price | Pros | Cons |

|---|---|---|---|---|---|

| Bitmain AntMiner S19 Pro | 110 Th/Ss | $3230 | 3250W | – Very fast hash rate – Ranks among the best mining machines |

– More expensive than most mining machines – High power consumption |

| Whatsminer M30S++ | 112 Th/S | $2455 | 3472W | – High-performance hardware – Very fast hash rate |

– More expensive – Power-hungry – Not ideal for beginners |

| Bitmain AntMiner T19 | 84 Th/S | $1755 | 3150W | – Fairly affordable compared to other machines | – Lower hash rate than top-end products |

| Bitmain AntMiner S9 | 14 Th/S | $246 | 1323W | – One of the most affordable mining hardware | – High noise levels – Low hash rate |

This above table shows some of the Bitcoin mining hardware that is available and there are numerous products on the market. Before buying an ASIC miner, make sure it is the latest version for your mining needs because they are constantly being updated and new machines hit the market at a rapid rate.

What Software Do I Need To Mine Bitcoin?

So you have your hardware all set up? The next step is to install Bitcoin mining software that will use your hardware to search for the correct hash. As important as hardware is to the mining process, software is equally important.

The software will work to make as many guesses as possible in the shortest amount of time to increase your chances of earning a BTC reward.

When deciding on the best software to choose, there are factors you need to keep in mind such as:

- Cost: Most Bitcoin mining software is free or offered at minimal cost. You do however have to look at the fees involved in using the software. Some may require up-front payments or regular service fees but ultimately, these fees could eat into your profits as will any withdrawal charges.

- Supported Operating Systems (OS): It is advisable to conduct thorough research on which OS each software supports. Most of them support Windows, Mac, and Linux but you may find others that don’t.

- Supported Hardware: Some software may be designed with specific hardware in mind. Make sure to choose one that supports your equipment be it a GPU or ASIC miner.

- Security: Because Bitcoin mining software is open-source and downloaded from the Internet, there is always a cybersecurity risk. Consider software that uses advanced encryption and SSL protocols to keep your computer safe.

- User Interface: Not all software works or looks the same so make sure you can understand the software’s interface. This is especially true for beginners.

Always recognize and accept your knowledge level before downloading any Bitcoin mining software. If you are a beginner diving in the deep end, there is a higher chance of you floundering and eventually giving up. Strategize on what needs the software to meet and find the one that best fulfills them.

Some of the top mining software you might want to consider include:

These have been ranked top in terms of cost, security, and additional features.

Now you have an impressive load of hardware and software. Let’s get you ready to start the mining process. Well, here’s how it works.

How Does Bitcoin Mining Work?

Here is a step-by-step on how to mine Bitcoin.

- Miners use mining hardware such as Antminer or Ebang that ideally, generate one Bitcoin every 10 minutes. They need to have computer knowledge to optimally operate the hardware.

- Each miner creates a secure Bitcoin wallet where they will receive their rewards if they are successful in adding a block to the blockchain.

- Using technical knowledge, miners install relevant mining software that needs to ensure maximum performance of their hardware.

- The miner downloads the full Bitcoin blockchain and starts mining.

- The mining hardware application starts running and you will need to monitor its progress.

NOTE by Ed Akins:The equipment needed to complete this process requires greater amounts of energy to operate.

Energy in the form of electricity lies at the core of Bitcoin mining and as we will see, it has a huge impact on how to mine Bitcoin. Before you venture into mining, you must know what is the electrical cost to mine Bitcoin.

How Much Energy Does It Take to Mine a Bitcoin?

Bitcoin mining is essentially the process of turning electricity into money. The mining process consumes approximately 0,5% of all global energy or 2% of the USA’s consumption.

Yearly, it also uses more electricity than Argentina, and around the same amount as the whole of Washington.

Statistics are quite shocking, but what do they mean for Bitcoin miners? The largest consumers of power are mining rigs made up of CPU, GPU, and ASIC miners. Anyone using these computers for Bitcoin mining is contributing to these high levels of power consumption.

According to CoinGecko.com, in July 2023, it cost an average household in the U.S. around $46,291 to mine one BTC. The price of Bitcoins at the time was $30,090 – 35% less than the cost of electricity.

Granted, miners earn 6.25 BTC per transaction they verify but with high power costs plus the capital invested in expensive equipment, Bitcoin miners need to take a long-term approach to profit-making.

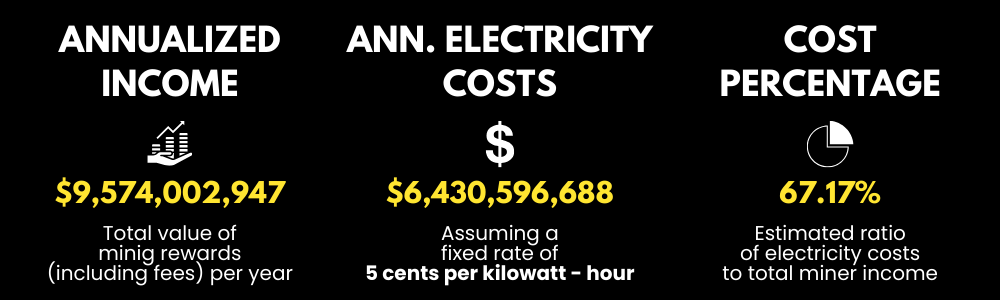

As of September 2023, the total value of rewards given to miners was $9,574,002,9 annually. Their annual total electricity costs calculated on a fixed five cents per kWh was $6,430,596,6. This translates into a ratio of energy costs to total miner income of 67,17%.

Bitcoin mining however is still profitable whether you practice pool mining or solo mining. We came across these terms earlier, but what do they mean?

Solo Mining vs Pool Mining Bitcoin

These are the two methods of Bitcoin mining and miners will fall into one or both of these categories. They determine their mining procedures, equipment, and the overall amount of rewards they can receive.

This table should be able to provide a brief description of each.

| Solo Mining | Pool Mining |

|---|---|

| Individual miners solve cryptographic puzzles alone to validate blocks for Bitcoin’s blockchain. | A group of miners connect their machines to add blocks to the blockchain. |

| Requires powerful equipment with high hash rates that is expensive to purchase and maintain. | Pool members can access high-powered ASIC miners that may be unaffordable for individuals. |

| Not ideal for beginners as it is geared to experienced miners. | Ideal for new users with a low hash rate. |

| Requires miners who are ready to deal with a potential lack of rewards. | Caters to individuals who are looking for consistent returns. |

| Solo miners do not share hashing power. | A pool of miners share their hashing power to solve equations. |

| Miners have complete control over their mining operations. | Pool members have no control over mining protocols or which transactions are included in blocks. |

| Miners assume all the risks involved in mining including equipment failure or disconnection from the Internet. | Risks are reduced as you are not in charge of checking or maintaining equipment or processes. |

| Income is unpredictable and infrequent depending on one’s ability to find a hash individually. | Income is steady as rewards are shared among members depending on their contribution. |

| Reliance on your own hash rate results in higher mining difficulty in solving a hash to find a block. | Less difficulty in adding a block due to the higher hash rate of the combined pool. |

If you choose to mine alone or in a pool, both options could be profitable as long as the value of Bitcoin remains high. Choose the method that best fits your experience level, risk aversion, and budget.

An alternative to traditional Bitcoin mining is cloud mining. It is ideal for those looking to mine Bitcoin without personally owning the specific mining hardware and software. If you are interested in this type of mining, you would rent out the mining hardware from a mining company. Two advantages include that you do not have to be technologically expert or have the capital investment to purchase the required equipment.

NOTE by Ed Akins:The equipment needed to complete this process requires greater amounts of energy to operate.

REMEMBER: Mining at home may be challenging due to the competition from large mining companies as well as the high cost of electricity.

FAQs

A viable option is to buy or build a custom computer with graphics cards to increase hashing power. Find a graphics card to install into your desktop with a minimum RAM of 6GB such as those from Nvidia. Some advanced laptops now also come with 6GPU RAMS. Be careful about mining on a laptop as they are prone to overheating and eventual breakage. Although you might be able to mine, you might not make a profit for years. They however strain your processors as they try to compete against powerful ASICs resulting in battery loss and overheating. Downloading the mining app is also dangerous so you will need to ask someone with the app to share the app with you. You then sign into the app and begin mining.

You will also need access to cheap electricity and a reliable 24/7 Internet connection. The first thing you need to do is download a Bitcoin wallet and mining software and then join a mining pool.

What else?

As we have seen, you could decide to mine alone or as part of a pool. Each type of mining has its pros and cons and depending on your equipment and level of expertise, make sure to start off using the right one.

Mining requires specialized hardware that operates using software that caters to different needs. Additionally, you can engage in cloud mining which will require less capital investment.

After reading this article, I am hopeful you will fully understand how Bitcoin mining works as well as the various types of mining. You must investigate all the pros and cons of the different options and choose one that will coincide with your level of experience. You also need to consider the financial repercussions in terms of energy usage and purchase of necessary software and hardware.