If you have ever thought of investing in cryptocurrencies, then you might have wondered ‘What happens if my bitcoin goes negative?’ Cryptocurrencies are known to be extremely volatile investments and can experience sudden highs and lows.

But to answer your question, no, Bitcoin or any other cryptocurrency cannot go negative. Nevertheless, you might lose money but the value of cryptos cannot go below zero. It is possible to hold negative bitcoin which would mean your coins are worth less than what you bought them for. This results in a negative investment account balance.

Additionally, there is always the risk of Bitcoin collapsing which would potentially have a negative effect on all cryptocurrencies worldwide.

Now, this may all sound a bit confusing but worry not, keep reading as we explain what happens if crypto goes negative.

But first, we need to understand how the price of cryptocurrencies is determined.

What Determines the Value of Cryptocurrencies?

Similar to securities, stocks, and bonds, cryptocurrencies are trading assets that are resold for profit. The major difference is that cryptos are decentralized and not backed by a central authority. Their value is determined by supply and demand which is affected by various factors.

Here, we will take a look at the major factors that influence the demand and supply of cryptocurrency and their value.

- Limited Supply

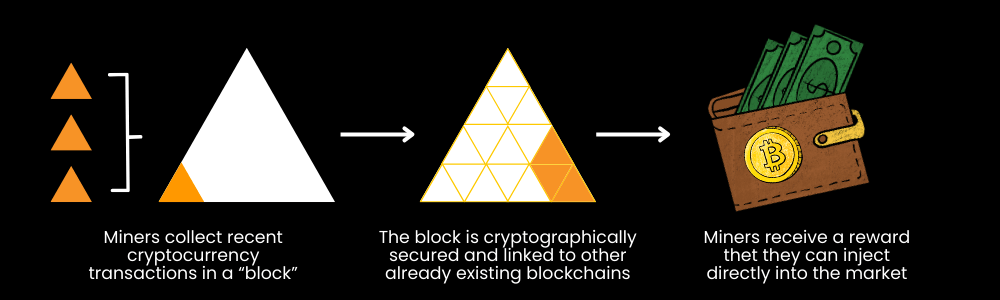

When cryptocurrencies are in short supply, miners will not be able to mine or create new coins. When maximum supply is reached, there is market scarcity which results in higher demand.This applies to Bitcoin which is capped at 21 million coins. Once this cap is reached, no more Bitcoin blocks can be created. This is one of the reasons Bitcoin is so popular.

Other currencies prevent oversupply by ‘burning’ coins. These coins are permanently removed from the Blockchain and locked in an inaccessible address. Consequently, they are not included in the total supply. A low supply of a currency is then likely to cause a rise in its price. - Mining Costs

Mining refers to the process of producing new crypto tokens. Miners compete to solve complicated mathematical problems to verify new blocks.As more miners join the race to verify these blocks, they will require more powerful hardware. This increases mining costs, resulting in higher crypto prices.

Provided the value of a currency is higher than mining costs, there will be a demand to use blockchains. - Increased Utility

When cryptos are used as a form of exchange in more businesses, their utility increases. Their value is also affected depending on the ability to use a currency on decentralized apps or protocols. - Level of Competition

A well-known theory in economics states that increased competition results in reduced demand for a specific asset. With over 23,000 cryptocurrencies having been invented, the crypto market is huge and extremely competitive. However, of these, approximately only 8,000 of these are active. The rest are either inactive or worth nothing.Although Bitcoin is the current ‘king of crypto’ its market share has been eroded, especially with the launch of Ether. On the other hand, increased competition has increased awareness of cryptos and Bitcoin prices have remained high. This is one of many reasons you don’t have to worry about what happens if cryptocurrency goes negative or Bitcoin goes to zero. - News & Media Coverage

Crypto prices can be greatly influenced by media coverage – more specifically social media. Positive news and social media hype can help increase the currency’s trading volume.

An example of this in action is the case of the Pepe meme coin. After trending on Twitter with $1.29 million tweets, Pepe’s price rose by 300% just one week after its launch.

Elon Musk’s tweets about Shiba Inu and Dogecoin also created public awareness of the currency. He went even further as to change the iconic Twitter blue bird logo to Shiba Inu, a move that increased the value of Doge coins by 30%. - Regulation & Governance

The regulations (or lack of) surrounding cryptocurrencies can be seen as a source of uncertainty. There is confusion as to whether cryptos are defined as a commodity such as gold, or as securities such as shares. As a result, they cannot be regulated by the Commodity Futures Trading Commission, nor by the Securities & Exchange Commission (SEC).If regulations were to be enforced, they could have either a positive or negative effect on the value of cryptos. The positive impact would be to increase investor confidence and they would feel more secure in purchasing cryptocurrencies.The negative impact however could lower demand as the rules of investing become more stringent. This in turn would lower the value of cryptos.Additionally, if governments were to create rules around cryptocurrency trading, investors may feel restricted, and limit their spending on cryptos.

- Economic Recessions

Economic downturns usually result in decreased consumer spending. Overall, unemployment tends to increase and consumer demand goes down.This demand reduction could affect the value of cryptocurrencies. This was clear in 2021 when there were rumors of a looming recession that caused cryptos to lose value. This decline saw cryptos decreasing in value from a high of three trillion dollars to $993 billion as of January 2023.The fear of a recession may affect cryptos more than other types of risky investments. Potential investors could be struggling with higher costs of living and are unable to afford to buy cryptos. - Availability

When a cryptocurrency is easily accessible, it will usually attract more buyers. Currencies that are available on many reputable exchanges cause a rise in demand which in turn results in increased prices.One example of the impact availability has on demand was seen in the case of Floki. After Floki tokens were listed on Binance US, their price increased by 50%. - Node Count

Node count refers to the number of computers within a crypto’s Blockchain. The more nodes a network has is an indication of the number of people interacting with that currency.A higher number of wallets in a network is indicative of a strong community and improves the chances of a currency recovering from a crisis. You can do a simple Internet search to get a currency’s node count.

Can You Lose Money on Your Crypto Investments?

Naturally, as a crypto investor, you will be looking for cryptocurrencies with the least amount of risk. You will want to choose those that have a proven track record.

Even if you are satisfied that your chosen currency is a safe investment, you should have a figure of how much money you are ready to lose.

As we have mentioned, cryptocurrencies are volatile, high-risk investments. This was evident when Bitcoin’s value went from a high of more than $68,000 in 2021 to less than $20,000 in June 2022.

So now you know how crypto prices are determined, I want to explain some ways you could minimize the chances of losing money on crypto. This is to answer the question every investor should answer before buying any crypto coins, namely, if crypto goes negative, do I owe money?

How to Avoid Crypto Losses

There are several ways to invest in cryptos including regular trading. Some of the riskier strategies however can reap enormous profits or tragic losses. The most common are margin trading and short-selling crypto.

What exactly are these trading methods and how do you minimize your risk level?

Margin-Trade Crypto Carefully

Margin trading involves taking out a loan from a broker or crypto exchange to buy more crypto coins than you would normally afford. Margin in this case refers to the collateral a borrower puts up as a deposit. This amount should be able to cover the credit risk to the lender as a result of declining crypto prices.

Why don’t I show you margin trading in action?

- You identify a lucrative crypto investment that you expect to rise in value.

- You don’t have enough capital to purchase the desired amount of coins.

- You borrow money from exchanges that offer this facility and you can buy the full amount of crypto you want.

- If the price of bitcoins increases, the value of your investment increases concurrently.

- When you are satisfied with the returns, or suspect the value of your coins could decrease, you close the position.

- You pay back the lender the amount of money borrowed plus any financing fees or interest.

- You recoup your original investment plus keep any profits gained.

Here is a short video explaining how Binance, one of the largest crypto exchanges, lets you delve into margin trading.

Margin calls are made by the exchange or brokerage you owe money. They will request you to increase the amount of your margin if its value decreases to such lows that the collateral you put down cannot support their margin.

A margin call would then need you to find funds or sell off assets to increase your collateral. If you cannot do so, the exchange might close or reduce open positions. This will obviously leave you in the red, especially if they liquidate assets or decrease positions when the market value of your cryptos is declining.

So addressing the question of ‘What happens if my crypto goes negative?’, it technically means your investment balance is negative, not the actual price of coins.

This could put you in debt as you will incur losses on your initial investment and eventually have to pay back what you borrowed.

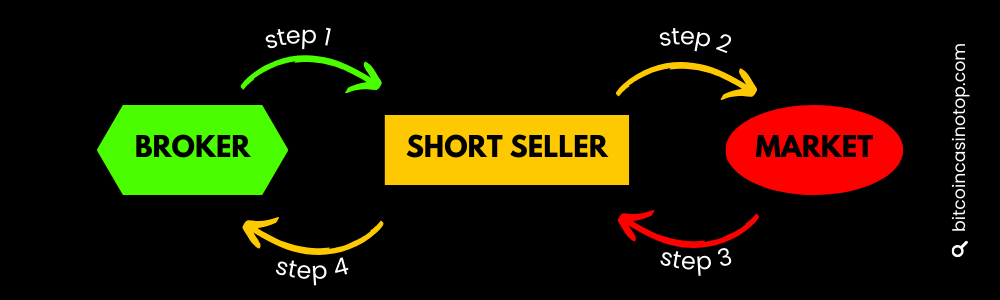

Beware of Short-Selling Crypto

Short-selling crypto can either earn you a profit or leave you in debt. These are the only options. In comparison to normal crypto trading, short-selling is a lot harder – especially for amateur investors.

When you trade in the traditional sense, you stand to lose just your original investment. With short-selling or shorting, you are at risk of losing money you don’t have.

Let me explain this briefly but first, take a look at this image that could make it easier to understand.

This investment strategy is based on the expectation that the price of a currency will go down. Below are the steps to short-selling.

- You borrow assets from an online broker which you predict will decrease in price.

- You sell the currencies at the current market value.

- The price of your coins decreases if your predictions are correct.

- You buy back the assets at a lower price than what you sold them for.

- The difference amounts to your profit.

- You pay back the broker the original amount of borrowed coins.

The risk lies in the case prices go up. If the value of a cryptocurrency increases, you will have to pay back a larger amount than your original borrowed amount.

This also means that although profits are usually capped, losses can keep increasing as the value of your currencies continues to rise.

For beginners, it would be wise to use automated trading bots that offer short-selling and margin trading capabilities.

There are numerous bots out there and many of them are free. Look for a bot that also allows you to test the waters before putting any actual money into the crypto market. This gives you the chance to practice and gain confidence in your trading skills.

The Importance of Risk Management

With the above crypto trading strategies in mind, it is key to fully understand how risk management works. Again, due to high levels of volatility, risk is a very real threat to any cryptocurrency investment.

Here are some quick tips to reduce this amount of risk.

- Hedge your funds: Hedging is a well-known method of protecting assets from a decline in value. It involves buying or selling assets to reduce the impact of losses or devaluation. Although hedging can result in decreased profits, it is one way to protect yourself from negative market swings.

- Diversification: Remember when I mentioned that competition in the cryptocurrency world is intense? Well, this same level of competing digital assets could keep you from losing money, even when cryptocurrency prices fall.Invest in more than one currency with the relevant information about their usage and technology. Different cryptos serve different purposes so think about what you need a currency to do, its history, and overall performance.

- Use Margin Selling Responsibly: As we have seen, margin selling crypto answers the question of ‘Can crypto go negative?’ A decline in the value of your crypto – even just 1% – can put your portfolio in the minus.Liquidations by your lender could result in a total loss of your portfolio, hence, you will be required to source funds to repay them.You might need to aim for a lower collateral that will allow you to increase your profits at a later stage, but also close your position before liquidation.

- Be cautious: Before investing in any asset, more so cryptocurrencies, ensure you have adequate information regarding risky areas. Don’t assume prices will rise and fall as per your predictions and plan for every possible outcome.

- Invest Only What You Can Afford to Lose: This is probably the key takeaway when it comes to investments. If you don’t have the money, don’t borrow to finance risky investment ventures. With variables like media speculation, government regulations, or other factors affecting supply and demand, cryptocurrencies have been known to create millionaires, while at the same time, leaving others debt-ridden.In addition to these, you could fall prey to hacking or shutdowns meaning all your cryptos will be lost forever.

- Store Your Crypto Offline: With the above point in mind, it is advisable to store your cryptocurrencies on a hardware or USB wallet.This will keep them safe in case of unwarranted access by bad actors on the Internet. As I explained in this article, the process of transferring cryptos to USB is not as complicated as it sounds. It will give you control of your coins and without Internet access, it is near impossible for hackers to access the private keys that let you transact with your cryptos.

I hope this article will be useful to anyone who has thought of investing in cryptocurrencies. More so, take my personal experience with a pinch of salt. Make sure to perform your due diligence and avoid making decisions based on emotion.

As we have seen, if the price of Bitcoins falls, there is a real threat of other currencies following suit. The good news however is that crypto can not go below $0 meaning if you have a long-term strategy, you could very well earn a handsome amount of profit.

Good luck!