By defining stablecoin, this article aims to fully explain what a stablecoin is. Basically, it is a type of digital currency similar to crypto coins but is pegged on an asset that can be considered stable such as gold or fiat currencies.

Let me break this down for you by looking at the types of stablecoins, how they work, and the benefits of investing in stablecoin.

What is Stablecoin?

The definition of stablecoins is all-encompassing and may seem confusing or too intricate -— especially for those new to digital assets. So to make this simpler for you, here is a breakdown of the stablecoin definition in easy-to-digest pieces.

Stablecoins are:

- A digital currency is considered a more stable (hence the name) medium of exchange than more volatile cryptos.

- They are pegged to tangible assets like real estate, fiat currency like dollar reserves, commodities such as precious metals, and financial assets like bonds.

- They reduce price volatility in comparison to cryptocurrencies including Bitcoin (BTC).

- They maintain reserve assets as collateral or by using algorithms to control the supply of the coins.

- They combine the stability of traditional assets with the flexibility of digital assets.

The coins have had massive growth with a more than 500% increase in the number of different coins from 2020 to 2021. Putting it simply, this was an increase in the supply of $130 billion in circulating supply. Currently, there are approximately 200 stablecoins in the market.

I hope this clarifies what stablecoins are and lays the foundation for understanding how they work. Keep reading as we delve in!

How Does Stablecoin Work?

What our experts found unique about stablecoins is that they can take advantage of cryptocurrency’s features such as speed, flexibility and security. All with the stability of a tangible asset.

They are native to the Internet and available 24/7 online which makes them accessible worldwide.

You should know about the different types of coins so let’s take a look at these and see exactly how they work.

Types of Stablecoins

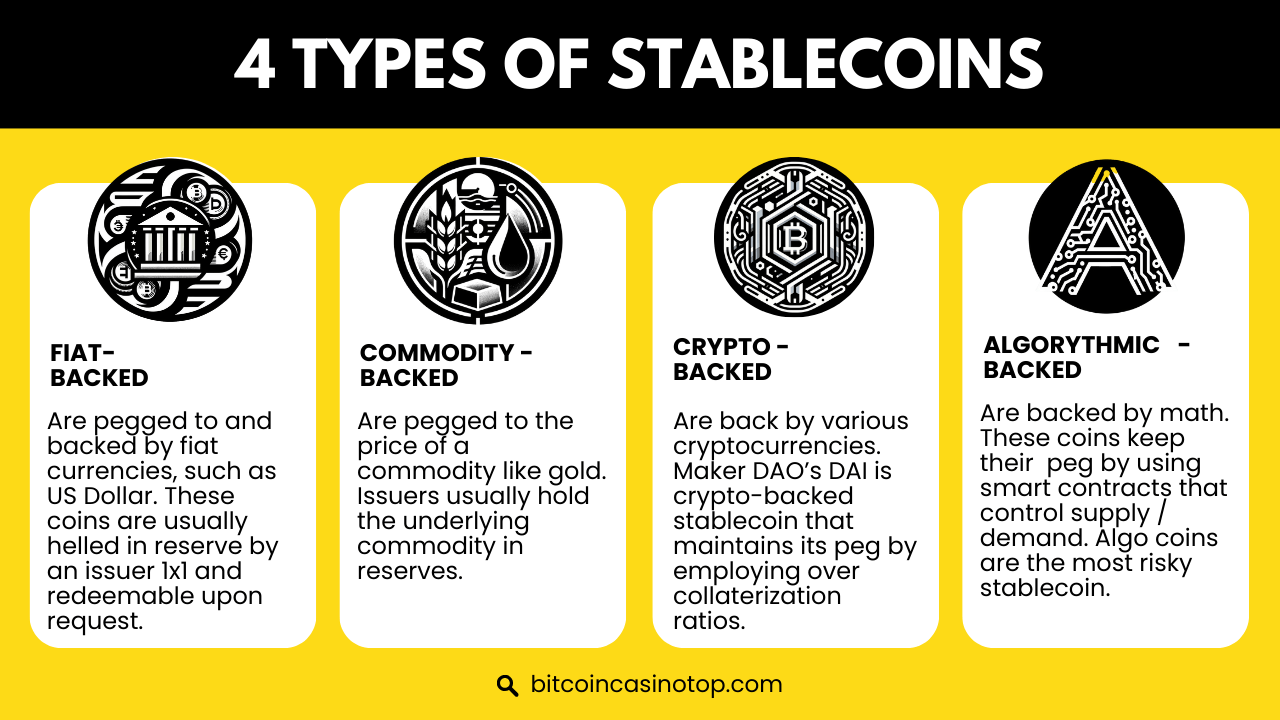

Before investing in a stablecoin, you will need to know which coin you are choosing to spend money on, so let me go over the four types of stablecoins.

-

-

Commodity – Centralized Stablecoins

These are stablecoins backed by tangible assets such as real estate, oil, and precious metals such as gold and silver. Because of the high value of the precious metals that back them, these stablecoins are quite rare but offer increased stability.An example is Paxoz Gold (PAXG) which is backed by 31.10 grams in the London Gold Delivery Market. This makes the price of one coin almost $1,800 making gold the most popular tangible asset used to peg stablecoins.

Advantages of commodity-backed stablecoins include:

- They hold the same value as the assets they are based on which is usually high.

- The ability to be sold when necessary.

- They are less volatile than fiat money and cryptocurrency meaning they are ideal for investors who cannot access these expensive assets directly.

To address the elephant in the room, they are less liquid than fiat-based coins.

-

-

-

Fiat-Collateralized Stablecoins

In comparison to the above stablecoins, fiat-backed stablecoins are the most popular and easy-to-find stablecoins. As the name suggests, they are backed by reserves of traditional fiat currencies including Dollars and Euros.These reserves must be held by regulated institutions like banks. They are backed at a rate of 1:1 so for example $1 equals one stablecoin.

Some types of fiat-pegged stablecoins include:

- Tether or USDT which is backed 1:1 with the dollar as mentioned above. This makes it one of the most sought-after stablecoins

- USD Coin (USDC) is also a popular stablecoin and has the same backing with the dollar of 1:1

One obvious advantage of fiat-backed stablecoins is they ensure some level of price stability because they are not affected by the fluctuations of supply and demand.

-

-

-

Algorithmic Stablecoins

One of the top algorithmic stablecoins is FRAX is designed to use advanced algorithms and leverage smart contracts to maintain price stability.

To clear this up for you, some advantages of algorithmic stablecoins include:

- Total decentralization.

- Trust and confidence because of the transparent and auditable algorithmic code.

- Little risk of user error because they do not use any tangible collateral.

-

-

-

Crypto-Collaterized Stablecoins

These are stablecoins backed by the reserve of other cryptocurrencies. Users receive stablecoins when they invest in a specific number of crypto coins.An excellent example of a top-rated crypto-collateralized stablecoin is DAI which works on the Ethereum blockchain. It is unique as the cryptocurrency that backs it is also locked into smart contracts.

Some advantages of this crypto are:

- Decentralized nature makes them transparent, secure, and protective.

- Transactions are recorded on a public blockchain making the stablecoin transparent and accountable.

- There is the opportunity to create leverage for trading as there is a trend of overcollarization.

-

-

Hybrid Stablecoins

Advantages of hybrid stablecoins include:

- They reduce the weaknesses of individual stablecoins.

- They are versatile as they can be used for long-term trading to make everyday transactions.

An example of hybrid stablecoins is the TerraUSD (UST) which is backed by the USD and a combination of fiat collateral and algorithmic rules. Another incentive to use this stablecoin is the use of smart contracts to respond to market conditions and manage the coin’s collateral ratio.

Another hybrid stablecoin to keep an eye on is Binance USD (Binance) which is backed by Bitcoin’s biggest marketplace and recognized as one of the best stablecoins. It is a combination of fiat and cryptocurrency collateral.

This backing from dollars and cryptos ensures flexibility and more stable price movements.

As I continue explaining what stablecoins are and how they are used, it is essential to look at their most prevalent pros and cons.

Benefits of Stablecoin

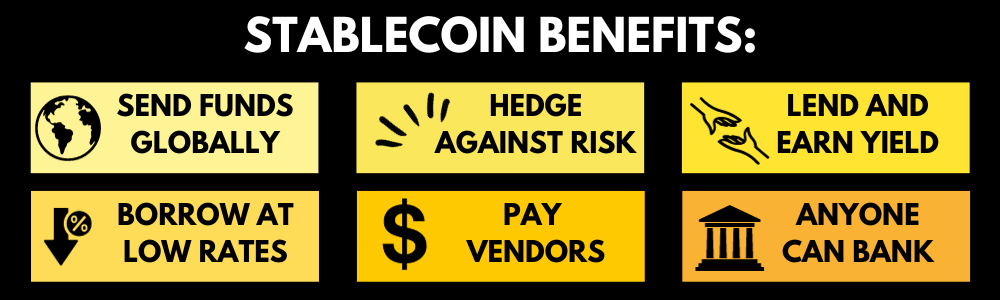

Like most digital assets, there are various benefits of stablecoins that make them attractive to prospective investors. Here are some of the best benefits offered by this digital asset.

- Their stability provides an opportunity for investors to earn a passive income with activities such as staking and lending.

- They can earn the owner interest rates higher than the regulated bank rates which could range from 5% to 15%.

- They offer easier methods of moving and distributing the coins across borders due to their stable value. This means you can spend the coins on purchases from around the world.

- Because they are pegged to more stable assets, they minimize volatility and assure customers that they won’t increase or decrease in price unpredictably.

- There is no need to hold a bank account to hold stablecoin globally even where US dollars are hard to obtain. This allows users to either trade or save the currency.

- Low transfer fees make it affordable to perform cross-border transactions when compared to traditional methods such as bank transfers or Western Union.

- They are an easy option for investors who wish to turn their crypto assets during a bear market.

- There is no need to turn crypto coins into fiat money and then into stablecoins. This process can be completed entirely via the blockchain in one transaction.

- They can be trusted to be a medium of exchange that will not lose its purchasing power with rises and drops in traditional cryptocurrencies.

Tip by Ed Ackins – Even with all the hype surrounding stablecoins being a fairly safe way to invest in crypto, the short downfall of Tether after it’s ‘stable’ 1:1 pegging with the U.S. dollar dropped by 1% in 2022 is something you might want to investigate. It may paint a different picture if you are looking to invest your life savings or your children’s college fund.

Risks of Stablecoin

Despite the high number of pros associated with it, some cons could keep investors away from stable currencies. It is crucial that I explain some of the major ones below:

- Because stablecoins are backed by other assets, if the collateral asset holder fails, the assets also fail meaning the value of investments decreases. This in turn impacts the trustworthiness of the entities that hold the currency reserves.

- Increased regulations to combat stablecoins’ potential to impact monetary policy and overall financial stability may affect investors negatively by limiting their usage and value.

- The nature of algorithmic stablecoins leaves their smart contracts and complex algorithms vulnerable to online attacks, bugs, and harmful behavior by bad actors. This is a risk you must be ready to handle and mitigate.

- There are liquidity risks if the stable market is flooded with sellers but does not have enough buyers. This increased supply compared to low demand could be an issue for coins with low adoption rates or smaller markets.

- Technical problems with the underlying blockchain or other underlying technologies could result in a loss to your investment.

Like with all investments, especially with digital assets, you should carefully examine the level of risk involved so you need to be prepared for a certain amount of risk.

And like I always say, as do most of those involved in crypto, only invest what you can afford to lose.

Difference Between Bitcoin and Stablecoin

Now that you have a better understanding of stablecoins, you might still be wondering – “Is Bitcoin a stablecoin?”.

Here is a quick comparison between traditional cryptocurrencies like Bitcoin and stablecoin so briefly, let me explain why Bitcoin is not a stablecoin in the below table.

Bitcoin is recognized as the first cryptocurrency and gained wide adoption due to its rapid price increases. It is recognized for its price volatility and its role as a high-risk speculative asset.

| Bitcoin | Stablecoin |

|---|---|

| Created as the first cryptocurrency | Created as a way to reduce the extreme price volatility of Bitcoin. |

| Known for its price volatility with extreme highs and lows. | Is based on the premise of stability. |

| Coins are not pegged to an underlying asset. | Coins are pegged to tangible assets or supply is controlled by smart contracts or complex algorithms. |

| Price is determined by changes in supply and demand. | Price is determined by collateralization, smart contracts, and algorithms. |

| Is not fully accepted as a medium of exchange yet due to its price instability. | Is widely accepted as a medium of exchange and accepted globally to complete purchases. |

| Is 100% decentralized. | May be in the control of centralized entities that control the reserves of collateralized stablecoins. |

Clearly, Bitcoin is not a stablecoin, it only shares the original blockchain technology. Otherwise, they do not share any of the same characteristics as you can see in the table above.

What is the State of Stablecoin Regulation?

Despite its rapid growth, failures in the stablecoin industry have highlighted the need for comprehensive regulations that will provide transparency, clarity, and intervention in this environment.

Previously, stablecoins had little to no regulation in the U.S., and federal agencies had no authority over the issuance of stablecoins. In 2022, the Biden administration began looking for ways to increase the regulations surrounding this currency.

Reasons given for this increase in this desire to control and centralize stablecoins is its ability to interfere with monetary policy and negatively impact financial systems. This would mean minimal protection of customers from bankruptcies and extreme price fluctuations.

Additionally, they would also be insured against theft and bankruptcy from the issuers of stablecoins who would have to comply with oversing and auditing from the federal governments.

Even though most of these restrictions are still in the books, stablecoins continue to operate largely unrestricted in a decentralized manner.

On a Final Note

We have seen that stablecoin moves beyond just being a cryptocurrency, and even though they have some similarities, they vary widely. I hope to make this even clearer by exploring what is the difference between stablecoin and cryptocurrency.

I have explained what stablecoins are as a form of digital currency that is controlled algorithmically instead of a central authority. By looking at the benefits of stablecoins, and by looking at the four different types of stablecoins, you can make an informed decision.

Remember there are two sides to this feature. On one side, you will not face the extreme dips in value often seen in cryptos, but you also won’t profit from the often sharp rise in crypto prices.

Investors need to choose between potentially huge gains or choosing a more risk-averse approach to investing in digital assets.

Please note, this article is not intended to provide financial advice. It is meant purely for educational purposes and to provide information.