Bitcoin regulation in New Zealand are multifaceted and ever-evolving. The country’s regulatory framework encompasses various aspects of financial conduct, anti-money laundering measures, taxation, and consumer protection. Our guide will delve into the current tax treatment of Bitcoin by the Inland Revenue Department and explore how the Financial Markets Authority (FMA) regulates businesses dealing in Bitcoin. In addition, we will highlight the ongoing discussions surrounding potential future regulations. By understanding this evolving landscape, we can gain valuable insights into how New Zealand approaches the exciting world of Bitcoin and other cryptocurrencies.

A Few Things You Need to Know about Bitcoin Regulation in New Zealand

- You can buy and sell cryptocurrencies in New Zealand.

- You owe capital gains tax on crypto profits.

- The FMA regulates crypto service providers.

- There are consumer protection laws to protect users and prevent money laundering.

- New Zealand cryptocurrency laws are likely to evolve in the future.

How Are Bitcoins Regulated In New Zealand?

The world’s first crypto coin, Bitcoin, has regulators scratching their heads. All over the world, they are struggling to define the coin’s legalities. According to Chris Skinner, a leading digital banker, Bitcoin is “a protocol, a commodity, a technology, a smart contract system, a general ledger, a secure exchange…. a many splendid thing.”

When defining Bitcoin, it can fall under any or all of the options below.

- Currency – cash;

- Payment system – PayPal;

- Security – bank account;

- Commodity – gold.

Our experts view Bitcoin as a combination of all the above characteristics. The definition of Bitcoin that is finally agreed on will play a massive role in the regulations set around it.

The Financial Markets Conduct Act 2013 (FMCA) is the blanket legislation covering all New Zealand financial products, including Bitcoin. It dictates that issuers of financial products must comply with:

-

- Fair dealing obligations and governance;

- Operational obligations, and

- Disclosure.

These provisions are meant to prevent unsubstantiated, deceptive, misleading, or outright false conduct. If your business is found to be non-compliant, you could face criminal/civic liability.

Let’s look at New Zealand cryptocurrency laws and their current position.

New Zealand Cryptocurrency Laws

There are various legal frameworks that make up the New Zealand cryptocurrency laws. These are;

- Taxation. The Inland Revenue Department (IRD) treats cryptocurrencies as property. For example, income from crypto-related activities such as mining and trading is subject to income tax. In addition, profits are taxed depending on the total income.

- Financial Services. The Financial Markets Authority (FMA) regulates businesses that provide services related to Bitcoin, such as:

- Cryptocurrency exchanges;

- Brokerages dealing in Bitcoin;

- Wallet providers;

- Businesses offering Initial Coin Offerings (ICOs).

These businesses need to be registered with the FMA and comply with existing financial service laws, including the Financial Markets Conduct Act (FMCA) 2013, Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT) 2013, and the Financial Service Providers Act (FSPA) 2008. These New Zealand cryptocurrency laws aim to prevent money laundering, ensure fair dealing, and protect consumers.

- Anti Money Laundering Countering Financing of Terrorism (AML/CFT). Cryptocurrency exchanges and service providers must adhere to AML/CFT regulations. They need to implement measures to prevent money laundering and terrorist financing, including customer due diligence and reporting suspicious activities.

- Legality: Buying cryptocurrency is legal in New Zealand. However, depending on your situation, profits from selling cryptocurrency may be subject to capital gains tax.

- Consumer Protection. Laws like the Fair Trading Act 1986 and the Consumer Guarantees Act 1993 apply to cryptocurrency transactions. These laws ensure that consumers are treated fairly and can seek redress for issues related to crypto trading.

Other essential information you need to know is:

NZ’s lawmakers’ current position.

NZ’s lawmakers’ current position.

- The Reserve Bank of New Zealand (RBNZ) has stated that BTC is not a currency.

- The Inland Revenue Department (IRD) has not yet clearly defined Bitcoin, but they apply the tax rules of a currency.

- The Financial Markets Authority has not commented on the status of Bitcoin.

- According to the RBNZ and Department of Internal Affairs (DIA), the crypto must adhere to the rules of the anti-money laundering legislation.

As you can see, the regulatory parties all have different views – or none at all.

As a crypto enthusiast in the region, you may find this information confusing. That’s why we’re here to enlighten you about Bitcoin’s status in New Zealand.

Bitcoin and Legal Compliance

Compliance with legislation is key for your crypto business to be legitimate. The two aspects of compliance you must consider include:

-

-

- The Anti-Money Laundering and Countering Financing of Terrorism Act 2000

- Customer Due Diligence (CDD)

-

Let’s take a quick look at these, shall we? They could greatly influence the future of your Bitcoin business.

Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT)

These AML/CFT policies regulate financial institutions, including small businesses and sole traders. They are designed to prevent money laundering and financing of terrorist acts. This New Zealand crypto law will probably bind you if you have a Bitcoin business in NZ.

This is especially true if your business does activities such as:

- Transferring money;

- Issuing money;

- Managing portfolios;

- Issuing and managing means of payment;

- Accepting deposits;

- Lending money.

Historically, Bitcoins’ reputation as a way for criminals to launder money means it is in your best interest to follow the rules. Technically, your business could find a loophole in the description provided in the AML/CFTAct, and you could get away with laundering money.

But beware!

Regulators from the DIA and the Reserve Bank have indicated they could interpret the Act more broadly. This means if you flaunt the rules, there is a chance it will be costly and time-consuming. If you want the public to view your business as legitimate, just adhere to the Act.

Steps to AML/CFT compliant

-

-

- Undertake a risk assessment of potential laundering and financial terrorism activities.

- Develop a compliance plan to detect, deter, manage, and mitigate Illegal activities.

- Appoint a compliance officer to keep track of this plan. Anyone in your organization can be the compliance officer.

- Report suspicious activities.

- Audit your risk assessment at least every two years.

-

Customer Due Diligence

This process is more complex than AMT and is necessary if you have a direct business relationship with your customers. It is also mandatory if you have an occasional transaction. Business relationships are defined when a customer interacts with you regularly. A good example is if you run a cryptocurrency exchange and require your customers to create an account. It does not refer to once-off transactions or those that the customer is not obligated to return. An example of this is Bitcoin ATMs, which are fully explained in our previous article.

If customers perform an occasional transaction, you must perform CDD regardless of whether you have a business relationship. This is when a client performs one or more transactions exceeding $9,999.99.

TOP TIP: WE ADVISE YOU TO CAP TRANSACTION AMOUNTS TO $10,000 IF YOU HAVE NOT PERFORMED CDD.

To comply with Customer Due Diligence, you must identify and verify who your customers are.

Steps to conducting CDD

- Get your customer’s full name and address.

- Verify their details.

You might be required to perform more comprehensive CDD actions if:

- The customer lives in a foreign country without sufficient anti-laundering measures.

- An individual wants to perform an unusually large or suspicious transaction.

- Customers are part of a specific type of legal entity.

As we can see, compliance with these two policies is indispensable and plays an important role when conducting business in the NZ crypto industry.

Bitcoin and Financial Service Providers

If your business is responsible for ensuring anti-laundering measures, you must comply with the Financial Service Providers Registration and Dispute Resolution Act 2008. Because your financial activities are similar to those defined in the AML/CFT Act, your business is defined as a financial institution or financial service provider.

Such businesses include:

- Cryptocurrency/Bitcoin wallet providers (read more about the importance of Bitcoin wallets here)

- Crypto exchanges and brokers

- Blockchain projects offering investment opportunities

- Block-chain based businesses with Initial Coin Offerings (ICOs)

More specifically, if your business manages a means of payment or falls under any of these categories, you will be termed a financial service provider. You will be obligated to follow the additional laws below.

- The Financial Markets Conduct Act 2013

- The Financial Advisors Act (for ICOs)

- The Financial Service Providers Act 2008

Does Bitcoin Fall Under Securities Legislation?

Because securities legislation often regulates alternative currencies, Bitcoin could be considered a security. This means regulators may focus on this feature of Bitcoin when creating legislation.

But there are a couple of speed bumps in instituting securities legislation, such as:

- Due to its decentralized nature, Bitcoin does not have one specific issuer, which means there is no person (s) to regulate it.

- Bitcoin is not explicitly defined as a financial product, so broking regulations probably don’t apply.

However, Bitcoin derivatives fall under securities legislation and, if you offer them as a product, you will need to have a product disclosure statement.

Bitcoin and Payment System Challenges for Regulators

Bitcoin’s relationship to payment systems is complex and raises questions about its classification under existing laws. As defined by the Reserve Bank of New Zealand Act 1989, a payment system is “a system or arrangement for clearing and settling payment obligations or processing payment instructions.” Bitcoin could possibly be termed a payment system if we use the above definition…but here are some reasons why it cannot under current laws…

- Bitcoin stands out from traditional payment systems by being decentralized. Traditional payment systems are operated by centralized entities, such as banks or payment processors, which provide oversight and compliance with regulatory requirements. The only power a Reserve Bank has over a payment system is to request information. But with regard to Bitcoin, who do they ask? The blockchain? Obviously, this is not possible as the blockchain is made up of a network of users across the world. There is not one specific person from whom the RBNZ can request information. Hence, regulations that control these systems do not apply to Bitcoin.

- Businesses associated with Bitcoin, such as cryptocurrency exchanges or payment gateways, could be seen as engaging in payment system-like activities. These entities facilitate the use of Bitcoin for transactions, acting as intermediaries between users and the broader financial system. Even if the RBNZ were to gain expanded powers over payment systems, they would probably only apply to those of great financial importance. If Bitcoin falls into this category, regulators are once again faced with the problem of who to call.

HINT: IF YOUR BUSINESS IS FAIRLY SMALL, THE RESERVE BANK IS UNLIKELY TO EXERCISE ITS POWERS ON YOU

Bitcoin’s contribution to payment systems remains relatively small in scale. Its transactions are only a drop in an ocean that transacts up to $35b daily. Nonetheless, as Bitcoin adoption grows, its relationship with payment systems may evolve, particularly if regulators address its unique characteristics.

NZ Cryptocurrency Taxes

Is Bitcoin Taxable?

Yes, Bitcoin in NZ is taxable. According to the Inland Revenue Department (IRD), cryptocurrencies are a taxable property as of 2018. If you sell Bitcoin or other fiat currencies, the government will tax you on your profit. Taxes also apply when you trade crypto or spend the coins to make a purchase.

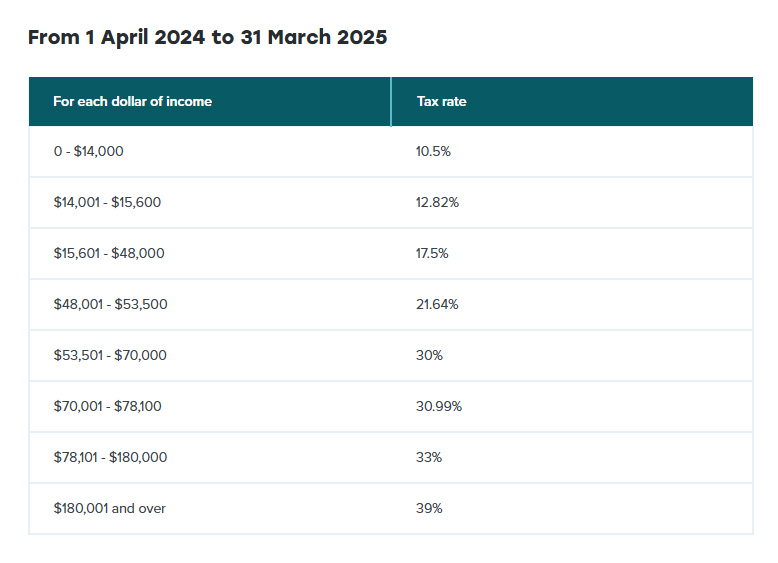

It’s essential to note that New Zealand uses a progressive income tax system. The capital gains tax rate on your crypto profits depends on your overall income for the year. It can range from 10.5% to 39%. The IRD considers income earned from mining or staking crypto as taxable income at your marginal tax rate. In addition, any cryptocurrency received through airdrops or hard forks is also taxed.

New Zealand’s tax framework for digital assets continues to evolve. While cryptocurrencies were exempt from Goods and Services Tax (GST) in 2020 to align with other financial services, new regulatory measures have been introduced. According to Cointelegraph, in August 2024, the government proposed implementing the OECD’s Crypto-Asset Reporting Framework (CARF), requiring crypto service providers to collect and report transaction data to the IRD starting in 2026. Noncompliance with these requirements could result in fines ranging from 20,000 to 100,000 NZD ($12,000 to $62,000).

If you sell, trade, or spend crypto in New Zealand, those transactions will be reported. So, it’s crucial to keep good records of your crypto transactions, including:

- Dates of purchase and sale;

- Purchase prices;

- Selling prices;

- Exchange rates used (if applicable).

This will help you accurately calculate your New Zealand crypto taxes including capital gains or losses for tax purposes.

For complex situations or specific tax advice, consider consulting a qualified tax advisor familiar with cryptocurrency regulations in New Zealand.

Is it Legal to Trade Crypto for Kiwis?

Yes, it is legal to trade crypto for Kiwis. The country has established a regulatory framework that allows individuals and businesses to engage in cryptocurrency trading as long as they adhere to specific laws and regulations. Some of these regulatory requirements include; AML/CFT obligations and tax laws.

Yes, it is legal to trade crypto for Kiwis. The country has established a regulatory framework that allows individuals and businesses to engage in cryptocurrency trading as long as they adhere to specific laws and regulations. Some of these regulatory requirements include; AML/CFT obligations and tax laws.

According to New Zealand cryptocurrency laws, cryptos are legal and treated as property. Kiwis can trade, spend, receive, and store cryptos. Remember, if you’re regularly trading crypto for goods, the IRD might consider it an income-generating activity, potentially leading to tax obligations. I hope we have answered the question: Is it legal to trade crypto for Kiwis?

What are The Potential Future Regulations for Bitcoin in New Zealand?

New Zealand has developed a comprehensive regulatory framework for Bitcoin and other cryptocurrencies. The government might enhance the existing framework to support the growing virtual industry better while addressing associated risks.

For example, there could be:

- Stricter Anti-Money Laundering (AML) procedures to combat illegal activities.

- Regulations could be introduced to strengthen consumer protection laws

- The Inland Revenue Department (IRD) might further clarify the tax treatment of crypto activities, such as airdrops and staking rewards. Taxation structures for businesses dealing with crypto might also be refined.

- More structured and comprehensive policies to regulate the cryptocurrency market effectively.

- The gambling market will be subject to expansion from New Zealand Bitcoin casinos.

- Discussions around the development of a Central Bank Digital Currency (CBDC), such as privacy, security, and the impact on monetary policy.

It’s essential to stay updated on developments from the New Zealand government and financial regulators like the FMA to understand how these potential regulations unfold.

The Bottom Line is…

Cryptocurrency is legal and widely accepted in New Zealand. For this reason, the government has implemented Bitcoin regulation in New Zealand to ensure appropriate regulation. These frameworks touch on taxation, consumer protection, and anti-money laundering measures. This approach allows individuals the freedom to buy and sell Bitcoin, but it also ensures some level of accountability within the industry. In addition, Bitcoin regulation in New Zealand aim to create a secure and transparent environment for digital assets, fostering industry growth while maintaining financial stability. Therefore, kiwis need to understand tax implications and comply with relevant laws.